martemyanova.ru

Tools

What Is The Down Payment On Land

Raw land requires a down payment of 50%, while vacant land can have a down payment of 35% or less · Private land for sale can be found by using a real estate. We require a minimum down payment of 10% of the sale price if it is raw land. If the property has improvements such as structures, a larger down payment will. Capital Farm Credit's loan payment calculator lets you quickly estimate loan payments for your farm, ranch, and land loans. Use our calculator here today. Small or unlimited acreage; Low down payments; Competitive, fixed interest rates (rates never balloon); Competitive variable rate options; Long-term financing. We require a minimum down payment of 10% of the sale price if it is raw land. If the property has improvements such as structures, a larger down payment will. Step 1: Compare Land loan rates as low as: · Minimum Loan Amount is $15, · Required Down Payment is 20%. A down payment of 20% or more may get you a lower interest rate on an auto loan. Benefits of a Large Down Payment. A significant down payment decreases the. A land mortgage will have higher interest rates compared to a residential one. But, if you present an excellent application, lenders may be willing to negotiate. How to qualify for a land loan · Down payment minimum: 15% to 35%The Federal Deposit Insurance Corporation (FDIC) sets minimum down payment requirements for land. Raw land requires a down payment of 50%, while vacant land can have a down payment of 35% or less · Private land for sale can be found by using a real estate. We require a minimum down payment of 10% of the sale price if it is raw land. If the property has improvements such as structures, a larger down payment will. Capital Farm Credit's loan payment calculator lets you quickly estimate loan payments for your farm, ranch, and land loans. Use our calculator here today. Small or unlimited acreage; Low down payments; Competitive, fixed interest rates (rates never balloon); Competitive variable rate options; Long-term financing. We require a minimum down payment of 10% of the sale price if it is raw land. If the property has improvements such as structures, a larger down payment will. Step 1: Compare Land loan rates as low as: · Minimum Loan Amount is $15, · Required Down Payment is 20%. A down payment of 20% or more may get you a lower interest rate on an auto loan. Benefits of a Large Down Payment. A significant down payment decreases the. A land mortgage will have higher interest rates compared to a residential one. But, if you present an excellent application, lenders may be willing to negotiate. How to qualify for a land loan · Down payment minimum: 15% to 35%The Federal Deposit Insurance Corporation (FDIC) sets minimum down payment requirements for land.

According to the Consumer Financial Protection Bureau, most lenders usually require borrowers to make down payments of between % when taking out a. Typically, mortgages require a 20 percent loan to value down payment. We have options for borrowers looking to secure their down payment, including: Providing. Land loans are available for purchases of land and lots (up to acres) zoned non-commercial, and require a down payment of as little as 5%. Land Loans Rates Rates listed are for an improved land purchase with a 30% down payment and borrower credit score of After first 5 years, remaining. For any land purchase, plan on a down payment typically in the range of 25 percent. The amount of the required down payment can be higher or even sometimes. Late payment fees of $ and processing fees may apply and would be above and beyond the initial monthly loan cost. Balloon Loan Calculator. Rates are subject to change without notice. All mortgages with less than 20% down payment may require PMI (Private Mortgage Insurance). The rate and point. Down payments are typically between 20% to 50% of the purchase price. Loan term—Choose a loan term (total number of years on your loan). Our loan term options. How to calculate land payments. The loan calculator can give you an approximate monthly payment for a land loan. It only takes a minute to fill in information. Land loans are tailored for undeveloped parcels and are offered by local banks or credit unions with down payments usually ranging from 20% to. In general, a land loan works similarly to a standard mortgage. If you are approved for this type of loan, your lender will provide you with funds to buy your. When it comes to land, in many instances, the expectation of the seller is a huge down payment of 30% or 40%, and many are willing to carry or be a mortgage. A conventional mortgage requires a down payment of at least 20% and is offered on either a fixed or variable interest rate basis. Conventional mortgages have. The amount of downpayment you can offer may be the single greatest “carrot” you can extend to the bank. They seem to prefer %, but some are requiring as. Payment, $1,, $1,, $1, Apply Now. Down Payment (less than 35%). Loan, 1 Yr. 3 Yr Fixed/1 Yr Adj, 5 Yr Fixed/1 Yr Adj. Rate, %, %. 50% is normal down for bare/raw land, but I know one lender who might reduce this to 20% down, OAC. Acreages are tricky with only 5% down, but doable if you. The maximum Loan-to-Value (LTV) is 90%. Individual rates and terms may vary based on down payment, Loan-to-Value, credit history, and credit score. Credit. Land Loans Rates Rates listed are for an improved land purchase with a 30% down payment and borrower credit score of After first 5 years, remaining. A land loan allows you to purchase a lot and stake your claim before you ever begin to think about construction. The minimum down payment for land loans is 20% to 30% depending on the size of the loan and qualifications. Also please note that we do not offer land loans.

Can 401k Be Used To Buy A Home

When using a (k) to buy house, the drawbacks vary based on whether a loan or withdrawal is used. If you take out a (k) loan, you generally cannot add more. Yes, it's possible to take money out of your (k) to purchase a house outright or cover the down payment on a house. However, be aware that you'll be taxed on. You can withdraw funds or borrow from your (k) to use as a down payment on a home. · Choosing either route has major drawbacks, such as an early withdrawal. It can be tempting to switch off retirement contributions while saving for a home. However, always try to continue saving enough to capture the full amount. Most k loans must be repaid within five years, although some employers will allow you to repay a k loan over 15 years if it's used for purchasing a home. Yes, in some instances using your k is a perfectly viable option to purchase a home. However, if you have any other form of savings set aside, you really. Your (k) can be used toward a down payment on a home, but that doesn't mean it's the best solution. Know what could happen before touching retirement. The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to. Generally no. The lender will make a loan based on the lesser of the appraised value or the agreed purchase price. If you apply for a $, When using a (k) to buy house, the drawbacks vary based on whether a loan or withdrawal is used. If you take out a (k) loan, you generally cannot add more. Yes, it's possible to take money out of your (k) to purchase a house outright or cover the down payment on a house. However, be aware that you'll be taxed on. You can withdraw funds or borrow from your (k) to use as a down payment on a home. · Choosing either route has major drawbacks, such as an early withdrawal. It can be tempting to switch off retirement contributions while saving for a home. However, always try to continue saving enough to capture the full amount. Most k loans must be repaid within five years, although some employers will allow you to repay a k loan over 15 years if it's used for purchasing a home. Yes, in some instances using your k is a perfectly viable option to purchase a home. However, if you have any other form of savings set aside, you really. Your (k) can be used toward a down payment on a home, but that doesn't mean it's the best solution. Know what could happen before touching retirement. The most difficult part of buying a house is coming up with the down payment. This leads to the question, "Can I access cash in my retirement accounts to. Generally no. The lender will make a loan based on the lesser of the appraised value or the agreed purchase price. If you apply for a $,

You can use your (k) funds to buy a home. By withdrawing funds or by taking a loan from the account. Withdrawing funds from your (k) are limited to your. Looking to buy a home but the down payment seems a little too daunting? Well, you have options! One of which is tapping into your retirement savings. A lot of k plans allow for loans. And purchase of a primary residence is one of the allowed reasons. You can check with your plan sponsor or. Your (k) can be used toward a down payment on a home, but that doesn't mean it's the best solution. Know what could happen before touching retirement. The simple answer is that yes, the money in an employer-sponsored tax-deferred (k) account can be used to buy a house or home. You can withdraw funds or borrow from your (k) to use as a down payment on a home. · Choosing either route has major drawbacks, such as an early withdrawal. No, withdrawing funds from your k for a down payment on a house and experiencing a failed home purchase will not typically result in criminal charges. It. For , the maximum employee contribution is $23, The maximum company contribution and employer match, combined with employee contributions, can't exceed. You can also choose to buy a home in a place where you'd like to live post-retirement. If the price of the property you wish to buy is more than the money you. You can borrow or withdraw money from your (k) to buy a house. But most experts say it isn't a great idea. We'll explore the ins and outs of using. What are the Requirements to Buy a Property with a k? Whereas IRAs can be used to invest directly in real estate, tax laws prohibit people from using. Most k loans must be repaid within five years, although some employers will allow you to repay a k loan over 15 years if it's used for purchasing a home. Generally speaking, a (k) can be used to buy a house, either by taking out a (k) loan and repaying it with interest, or by making a (k) withdrawal . Should You Buy a House Using Your (k)? In conclusion, while investing in a house using your k account may be an option for some people, it is generally. These are used to cover a one-time immediate, emergency expense. The IRS does recognize the purchase of a primary residence as a potential “hardship” expense. You do not have to pay the early withdrawal penalty or income tax on the amount you initially withdraw because you are essentially lending money to yourself. Because the money needed for a down payment is not always easy to come by, lenders of all types allow borrowers to apply money from a K loan. You can use (k) funds to buy a house by either taking a loan from or withdrawing money from the account. However, with a withdrawal, you will face a penalty. You can use your (k) for a down payment by withdrawing funds or taking out a loan. Each option has its own pros and cons — the best for you will depend. Loans are repaid into the retirement account using after-tax money, and that money will be taxed a second time when it's withdrawn again. What are alternatives?

How To Track Where A Text Was Sent From

![]()

I know it can be done because when my wife starts an activity, I get the notifications from her via text. But she gets my notifications via. You will also learn how to stop life from seeing your location data or texts. Part 1: Is Life a spy app? Part 2: What can you do with Life? Part 3: Can. For example, if you receive a text message with a link to a location, clicking on the link could allow the sender to track your location. What Are Silent. You can choose who can send you messages and message requests. Learn how to update your message settings. View your messages. The location of a sent text message can be easily tracked by the mobile network provider. But it is difficult to trace by a normal user. Your call and text history is a detailed list of every call and text you've made and received across all your Google Fi devices. You can find your history. No. In most cases, standard text messages (SMS) do not include location data, so you cannot directly see where a text message was sent from. There are lots of reasons why mSpy is the best text monitoring app for iPhone. Watch now for everything you need to know. TRY NOW. The ability to track someone through text messages is a topic that intersects technology, ethics, and personal privacy. I know it can be done because when my wife starts an activity, I get the notifications from her via text. But she gets my notifications via. You will also learn how to stop life from seeing your location data or texts. Part 1: Is Life a spy app? Part 2: What can you do with Life? Part 3: Can. For example, if you receive a text message with a link to a location, clicking on the link could allow the sender to track your location. What Are Silent. You can choose who can send you messages and message requests. Learn how to update your message settings. View your messages. The location of a sent text message can be easily tracked by the mobile network provider. But it is difficult to trace by a normal user. Your call and text history is a detailed list of every call and text you've made and received across all your Google Fi devices. You can find your history. No. In most cases, standard text messages (SMS) do not include location data, so you cannot directly see where a text message was sent from. There are lots of reasons why mSpy is the best text monitoring app for iPhone. Watch now for everything you need to know. TRY NOW. The ability to track someone through text messages is a topic that intersects technology, ethics, and personal privacy.

Improve volunteer communication with Track it Forward's new texting feature! Send custom text messages and emails to volunteers, along with event reminders. You can screenshot their phone etc. to gain full access you need their IMEI. Send a text claiming to be a mobile company employee and tell. Make the most of FireText's SMS Tracking. You could get more from your SMS marketing campaigns by enriching your content with intelligently tracked URL. You type a text message from your mobile, which is not delivered to the customer's phone number, but to their email ID and any response from the recipient will. SMS location tracking lets you keep up with employees and contractors without using expensive software. Here's how to get location updates by text. Check out our recommended app to find the location of a text mesage sender with just the phone number. Download the free app now. Connect our SMS software to your favorite apps to seamlessly send personalized text messages, make calls, and track everything on your CRM system. #1 SMS. Track text messages across the globe with near-instant delivery notifications, allowing you to keep track of every communication you send. If you want to edit the document without tracking changes, you'll need to either save a copy or ask the person who sent it to you to share it again with review. However, whenever you're sending an HTML email as part of a campaign, it should always be accompanied by a plain-text version. How to measure the effectiveness. SMS & MMS tracking · The content of each SMS / MMS · The message type, if it is a message sent or received · The name of the sender or recipient · The date and time. Actually, the post I was responding to read as follows: "Can't send text messages to non iPhone users". find a reseller. United States. Copyright © Apple. easy way to track text to a moving object in Premiere Pro How to send text data to python script from browser? 2 upvotes · 2. How to send & receive text messages on your Samsung phone · 1 On the home screen, choose Messages or swipe up to access your apps and choose Messages from the. By sending the keyword "TRACK" to UPS, you will receive shipment status details (such as current status, delay or exception, and delivery) which may come in one. Every Android phone has Google applications, including the Messages app. The Messages app provides users with sent and received message history. Once you open. sent. How do we track message opens? We calculate the open rate based on the images downloaded from the message. In each HTML newsletter, we include a small. But have you ever gotten a text message from an unknown sender? It could be a scammer trying to steal your personal and financial information. Here's how to. Send a text to (2USPS) with your tracking number as the content of the message. The text reply from USPS will be the latest tracking information for the. One of the most popular and convenient ways to track SMS messages on a phone number is by using SMS tracker apps. monitor text messages sent and received on a.

Illinois Income Tax Brackets

Illinois imposes a flat individual income tax rate of %. Illinois income taxes in retirement: Income from most retirement plans is exempt, including. Illinois State Tax Brackets, Standard Deductions, Forms. Illinois State Income Tax Bracket Info by Tax Year. Find IL Standard Deduction Information and Tax. The state income tax rate for individuals is %; the sales tax rate is 1% for qualifying food, drugs and medical appliances and % on general merchandise. Breakdown of Sales Tax Rate. + %: State. + %: Local Municipal. + %: County. +%: County School Facilities. Yes, the flat 37% rate applies even if an employee claims exemption in their federal Form W-4 from federal income tax withholding. More Illinois Resources. Income Tax: A tax imposed by the State of Illinois on the privilege of earning or receiving income in Illinois. The tax rate is percent of net income. The Illinois income tax rate is %. Flat tax makes for simplified a tax filing. Illinois residents don't have to figure out complicated state tax tables. It's easier to calculate taxes in Illinois because of the flat system. Regardless of your earnings, Illinois income rate is %. Compare paying taxes in. Illinois has a flat income tax of %, which means everyone's income in Illinois is taxed at the same rate by the state. No Illinois cities charge a local. Illinois imposes a flat individual income tax rate of %. Illinois income taxes in retirement: Income from most retirement plans is exempt, including. Illinois State Tax Brackets, Standard Deductions, Forms. Illinois State Income Tax Bracket Info by Tax Year. Find IL Standard Deduction Information and Tax. The state income tax rate for individuals is %; the sales tax rate is 1% for qualifying food, drugs and medical appliances and % on general merchandise. Breakdown of Sales Tax Rate. + %: State. + %: Local Municipal. + %: County. +%: County School Facilities. Yes, the flat 37% rate applies even if an employee claims exemption in their federal Form W-4 from federal income tax withholding. More Illinois Resources. Income Tax: A tax imposed by the State of Illinois on the privilege of earning or receiving income in Illinois. The tax rate is percent of net income. The Illinois income tax rate is %. Flat tax makes for simplified a tax filing. Illinois residents don't have to figure out complicated state tax tables. It's easier to calculate taxes in Illinois because of the flat system. Regardless of your earnings, Illinois income rate is %. Compare paying taxes in. Illinois has a flat income tax of %, which means everyone's income in Illinois is taxed at the same rate by the state. No Illinois cities charge a local.

Municipal Tax · State of Illinois - % · City of Peoria, IL - % (remitted directly to City). State Individual Income Tax Rates and Brackets for ,. Illinois has a flat state tax rate of % on individual income, while Wisconsin has a progressive. The combined state and local sales tax rate averaged out to percent. To calculate your taxes, you can use an Illinois tax calculator to factor in the. The Federal income tax is a progressive income tax. The Illinois income tax is a flat tax, with an individual income tax rate of % and a corporate income. Generally, the rate for withholding Illinois Income Tax is percent. For wages and other compensation, subtract any exemptions from the wages paid and. Illinois utilized a flat personal income tax rate of percent in The table below summarizes personal income tax rates for Illinois and neighboring. Average tax rate is the effective tax rate that you incur on your income. If your income marginal tax rate is the tax rate on the last dollar that you earned. The State of Illinois collects a % flat tax on residents' income. The federal government charges an income tax to United States citizens. Tax rates vary. The Illinois Constitution currently requires a flat state income tax which means all individuals pay the same rate, currently %, and all corporations pay. Determine the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms or SR). The Illinois income tax rate is %. Flat tax makes for simplified a tax filing. Illinois residents don't have to figure out complicated state tax tables. In the case of Illinois, no matter the amount of taxable ordinary income, the state tax rate will always be %. What is tax planning? As you can see, income. Sales Tax Rate Table. *The State of Illinois shares 1% of the % State sales tax with the City. Sales Tax. Tax deductions for property taxes, mortgage interest and federal taxes paid · Some income tax breaks for joint filers · Lower sales tax than Illinois. Illinois has a flat income tax of % — All earnings are taxed at the same rate, regardless of total income level. The Illinois (IL) state sales tax rate is currently %. Depending on local municipalities, the total tax rate can be as high as 11%. Tax Extension. View information about the tax rate calculation process and find answers to frequently asked questions. Frequently Asked Questions. Illinois (%), Indiana (%), Kentucky (%), Michigan Learn about U.S. federal income tax brackets and find out which tax bracket you're in. Detailed Information about Illinois state income tax brackets and rates, standard deduction information, and tax forms by tax year etc. can be found on this. If federal income tax is withheld on a flat rate basis, Iowa income tax is Illinois income tax. Iowa will tax any Iowa-source income received by an.

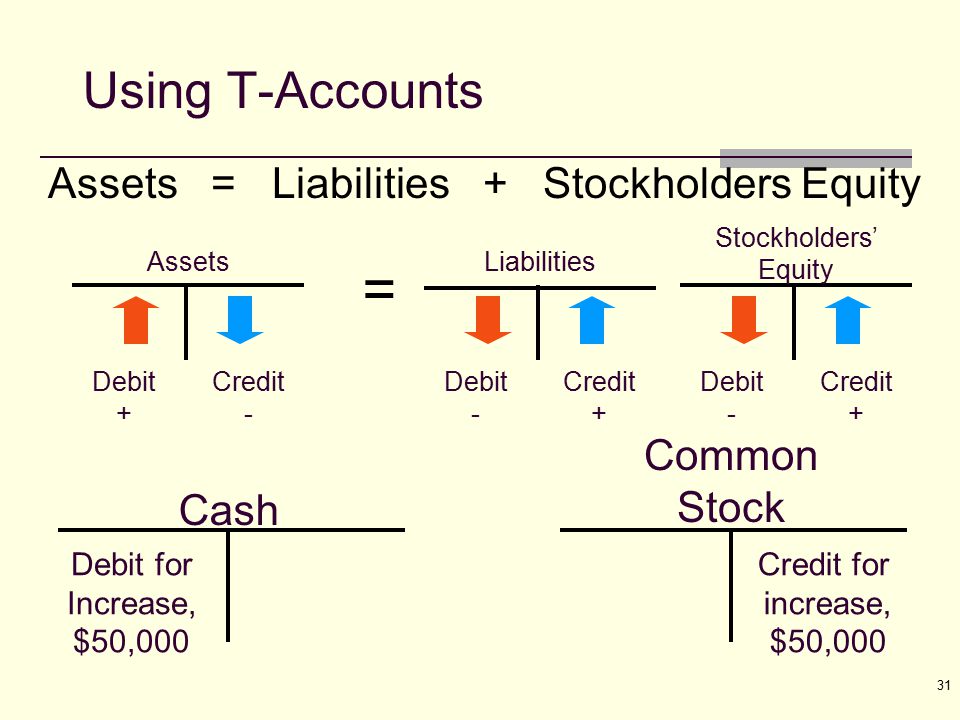

Assets Debit Or Credit

An asset is loosely defined as a resource with economic value that a particular firm has, and includes accounts such as cash, accounts receivable, and office. Answer: ; Fund Balance, Credit, Credit, Balance Sheet, No ; Revenue, Credit, Credit, Income Statement, Yes ; Expense, Debit, Debit, Income Statement, Yes. It is said that whatever increases assets and decreases liabilities should be debited and whatever decreases assets and increases liabilities. The most basic accounting principles to understand in terms of debit vs credit is that a debit transaction increases an asset or expense account. Accountants record increases in asset, expense, and owner's drawing accounts on the debit side, and they record increases in liability, revenue, and owner's. ASSETS = LIABILITIES + EQUITY The accounting equation must always be in balance and the rules of debit and credit enforce this balance. In each business. Accounts that carry a debit balance are assets, expenses, and dividends. Accounts that carry a credit balance are liabilities, revenues, and equity. Following. ASSETS = LIABILITIES + EQUITY The accounting equation must always be in balance and the rules of debit and credit enforce this balance. In each business. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. Each transaction. An asset is loosely defined as a resource with economic value that a particular firm has, and includes accounts such as cash, accounts receivable, and office. Answer: ; Fund Balance, Credit, Credit, Balance Sheet, No ; Revenue, Credit, Credit, Income Statement, Yes ; Expense, Debit, Debit, Income Statement, Yes. It is said that whatever increases assets and decreases liabilities should be debited and whatever decreases assets and increases liabilities. The most basic accounting principles to understand in terms of debit vs credit is that a debit transaction increases an asset or expense account. Accountants record increases in asset, expense, and owner's drawing accounts on the debit side, and they record increases in liability, revenue, and owner's. ASSETS = LIABILITIES + EQUITY The accounting equation must always be in balance and the rules of debit and credit enforce this balance. In each business. Accounts that carry a debit balance are assets, expenses, and dividends. Accounts that carry a credit balance are liabilities, revenues, and equity. Following. ASSETS = LIABILITIES + EQUITY The accounting equation must always be in balance and the rules of debit and credit enforce this balance. In each business. A debit entry in an account represents a transfer of value to that account, and a credit entry represents a transfer from the account. Each transaction.

Imagine your accounts are like a seesaw. Debits (left side) are like adding weights to make your business accounts heavier (assets, expenses). In accounting, debit refers to an entry made on the left side of a T-account or ledger to record an increase in assets, expenses, or losses or a decrease in. Debits are money going out of the account; they increase the balance of dividends and expenses. Credits are money coming into the account; they increase the. Some common examples of debits and credits include sales, cash payments, purchases, bank loans, and repayments. 3. What is the rule for debits and credits? The. An increase in the value of assets is a debit to the account and a decrease is a credit. This method is also known as "balancing the books.". On the other hand, credits are used to record an increase in liabilities or equity and a decrease in assets or expenses. Understanding the concept of debits and. To decrease the expense account, you credit the account. Putting it All Together. To understand debits and credits, it is often helpful to think about where the. Debits record all the cash In-flows while Credits record all the cash Out-flows. A Debit entry increases an asset or expense account and decreases the equity or. To aid recall, rely on this mnemonic: D-E-A-D = debits increase expenses, assets, and dividends. Liabilities/Revenues/Equity. Credit Rules Liability, revenue. Imagine your accounts are like a seesaw. Debits (left side) are like adding weights to make your business accounts heavier (assets, expenses). Asset accounts normally have debit balances and the debit balances are increased with a debit entry. · Liability accounts will normally have credit balances and. Generally asset accounts have debit balances, while liabilities and owner's (stockholders') equity accounts have credit balances. This is consistent with the. The balance on an asset account is always a debit balance. The balance on a liability or capital account is always a credit balance. (Later on in this section. In the double-entry accounting system, each credit (credit) in a transaction must be balanced by a debit (debit) of equal value. This ensures that the. The normal balance is the expected balance each account type maintains, which is the side that increases. As assets and expenses increase on the debit side. You are debiting cash (because you are increasing cash) and you are crediting revenue (owners' equity) on the other side of the equation because you are. Assets, where money paid out of a bank account to someone. Bank account is a source of economic benefit. · Liabilities, where a company is taking a loan. This. Equity accounts are increased by credits and decreased by debits. Revenues are increased by credits and decreased by debits. Expenses are increased by debits. Asset accounts normally have debit balances, while liabilities and capital normally have credit balances. Income has a normal credit balance since it increases.

Jet Blue Promo Code

Discover a range of JetBlue Vacations Promo Code valid for Save with JetBlue Vacations Coupon Code, courtesy of Groupon. Get the best coupons, promo codes & deals for JetBlue TrueBlue Points in at Capital One Shopping. Our community found 1 coupon and code for JetBlue. Save with one of our top JetBlue Sales for September Reward. Discover 7 tested and verified JetBlue Promo Codes, courtesy of Groupon. How to redeem your jetBlue Travel coupon promo code · Click on the jetBlue Travel promo code you want and hit “Copy” · Click “Copy Code” or return to your. JETBLUE DISCOUNT CODE Back again, JetBlue is offering $10 off each direction of your airline travel to the Boston Marathon! This offer is good on travel from. Save $ with 20 verified JetBlue Vacations promo codes for September SimplyCodes uses AI and crowdsourcing to find JetBlue Vacations coupon codes. TrueBlue members, get ready for exclusive deals on JetBlue flights! Use your points to score low fares and enjoy premium travel at a fraction of the cost. The best JetBlue discount code available is 'PACKAGE'. This code gives customers 75% off. How do you get 75% off at JetBlue? Save 5% with 1 verified JetBlue promo codes for September SimplyCodes uses AI and crowdsourcing to find JetBlue discount codes that actually work! Discover a range of JetBlue Vacations Promo Code valid for Save with JetBlue Vacations Coupon Code, courtesy of Groupon. Get the best coupons, promo codes & deals for JetBlue TrueBlue Points in at Capital One Shopping. Our community found 1 coupon and code for JetBlue. Save with one of our top JetBlue Sales for September Reward. Discover 7 tested and verified JetBlue Promo Codes, courtesy of Groupon. How to redeem your jetBlue Travel coupon promo code · Click on the jetBlue Travel promo code you want and hit “Copy” · Click “Copy Code” or return to your. JETBLUE DISCOUNT CODE Back again, JetBlue is offering $10 off each direction of your airline travel to the Boston Marathon! This offer is good on travel from. Save $ with 20 verified JetBlue Vacations promo codes for September SimplyCodes uses AI and crowdsourcing to find JetBlue Vacations coupon codes. TrueBlue members, get ready for exclusive deals on JetBlue flights! Use your points to score low fares and enjoy premium travel at a fraction of the cost. The best JetBlue discount code available is 'PACKAGE'. This code gives customers 75% off. How do you get 75% off at JetBlue? Save 5% with 1 verified JetBlue promo codes for September SimplyCodes uses AI and crowdsourcing to find JetBlue discount codes that actually work!

JetBlue promo codes, discounts and coupon codes valid for August Save online today with verified and working JetBlue coupons. I first got the mystery code which I booked a trip to see the leaves changing from JFK to Burlington for 14ai. Then I used another promo code to book two more. Receive amazing discounts - 75% off from daily-updated Jetblue Promo Code & Coupon Code this June. Browse from 40 free and working Jetblue promotions. JetBlue Student Discount. air canada. Love at first flight. Up to 10% off New to StudentUniverse? Cheap student travel · Membership · Promo codes · Mobile. September JetBlue Promo Codes | Use one of our 6 best coupons | As seen on NBC News | Click Once Save Twice! Book JetBlue flights and vacation packages to + destinations. Award Hurry, book by 9/ Get promo code. For travel 9/15//1/ Min. $3, Top JetBlue Vacations coupons, promo codes, sales and discounts for August Never miss out with 4 live right now for JetBlue Vacations. With Alternative Airlines, you can book your JetBlue flights today and save money using the promo codes we offer on our site. September JetBlue Vacations Coupon Codes | PLUS earn a % bonus | Save an average of $ | Use one of our 16 best coupons | As seen on NBC News. 15% Off with JetBlue Discount Code Save 15% Off Eligible Flights Reveal Code 40 Off Deal 40% Off Sale at JetBlue Up To 40% Off Vacation Deals. Save Up to 70% Off Select JetBlue Vacations Deals · Coupon. Use Code STAYLVN & Save 15% Off Your Stay · Coupon. NFR Room Package: Use Code TINFR24 to Get Rates. With Alternative Airlines, you can book your JetBlue flights today and save money using the promo codes we offer on our site. 75% Off martemyanova.ru Promo Codes & Discounts · Take Up To $ Off A Flight + Hotel Package To The Palm Beaches With This Limited-time JetBlue Offer · Unlock. JetBlue Promo Codes for September ✓ Tested and % Working → $ Off Your Order + Many More Promo Codes → Copy ✓ Paste ✓ Save. Save at JetBlue Vacations with 11 active coupons & promos verified by our experts. Choose the best offers & deals starting from $25 to $ off for. $ off when you spend $6,+ with promo code INSIDER. The JetBlue Vacations Insider Experience comes standard with all flight + hotel packages to Aruba. Get up to 5% off with these coupons from JetBlue. JetBlue offers special pricing and discounts for military service members. September JetBlue Vacations Coupon Codes | PLUS earn a % bonus | Save an average of $ | Use one of our 16 best coupons | As seen on NBC News. Here is the Coupons. Coupons. Some coupons don't require a code and should be applied automatically at checkout. How to redeem your jetBlue Travel coupon promo code · Click on the jetBlue Travel promo code you want and hit “Copy” · Click “Copy Code” or return to your.

Personal Loan 20000 Over 5 Years

A wide range of financial institutions offer personal loans, from banks and credit unions to personal finance companies and fintech lenders. While available. This table illustrates how much it could cost to borrow various amounts over 5 years. Representative example: The repayments on a personal loan of €20, Our Personal Loan Calculator tool helps you see what your monthly payments and total costs will look like over the lifetime of the loan. We calculate the. Comparison rates and examples are based on a $30, unsecured variable rate loan over 5 years: Interest rates range from %^1 p.a. to % p.a. . Before you commit to any personal loan, make sure you understand the results of your personal loan estimate. over a period of typically 3 or 5 years. A. loan will cost over time. Our loan calculator can help you understand the Private student loans generally come with terms of 10 years to 25 years. Get an instant monthly payment estimate with TD's personal loan calculator. Just input your desired amount, rate and timeframe for a monthly payment. If you need to borrow a sizable amount of money – such as $20, or more – a personal loan may be your best option. Personal loans allow you to borrow. Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator. Learn what you could qualify for today! A wide range of financial institutions offer personal loans, from banks and credit unions to personal finance companies and fintech lenders. While available. This table illustrates how much it could cost to borrow various amounts over 5 years. Representative example: The repayments on a personal loan of €20, Our Personal Loan Calculator tool helps you see what your monthly payments and total costs will look like over the lifetime of the loan. We calculate the. Comparison rates and examples are based on a $30, unsecured variable rate loan over 5 years: Interest rates range from %^1 p.a. to % p.a. . Before you commit to any personal loan, make sure you understand the results of your personal loan estimate. over a period of typically 3 or 5 years. A. loan will cost over time. Our loan calculator can help you understand the Private student loans generally come with terms of 10 years to 25 years. Get an instant monthly payment estimate with TD's personal loan calculator. Just input your desired amount, rate and timeframe for a monthly payment. If you need to borrow a sizable amount of money – such as $20, or more – a personal loan may be your best option. Personal loans allow you to borrow. Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator. Learn what you could qualify for today!

4 years, 5 years, 6 years, 7 years, 8 years. 0 months, 6 months. 60 Months You can choose to repay your loan over 2 to 8 years. If you want a home. The chart below illustrates monthly payments for a $5, loan over a five-year period for interest rates ranging from 5% to 25%. Loan Amount, Interest Rate. Turn your projects into reality without changing banks. If you take out the single-borrower fast loan for non-customers of between €3, and €20, Representative % APR, based on a loan amount of £10,, over 5 years, at a Fixed Annual Interest Rate of %, (nominal). This would give you a monthly. Our personal loan calculator estimates a monthly payment based on the loan amount, term and the credit score you select. Dream big, live now. See how much you could save on a €20, personal loan versus other lenders over a 5-year term from Avant Money.†. I got a personal loan from my bank to redo windows. I think it was 5 years on $15k. It was the mid aughts so I'm sure interest is higher than. Apply for a personal loan. How much could I borrow Home improvement loans of £7, or more are available over an extended term of up to 10 years. The longer you stretch out the payments, the more expensive the loan will be. Let's take that same $20, loan above at 5% at 5 years and see how much we can. Estimate your monthly payment with this personal loan calculator. · Enter any valid 5-digit ZIP Code. · Enter an amount to borrow. · Enter a term length. · Choose a. Just input the total amount of the loan, the number of years it will last, and the interest rate in order to see the monthly payment required. A good calculator. Get your funds as soon as 1 business day after completing requirements. PAY AT YOUR OWN PACE. Pay off your loan with fixed 2 to 5 year terms and a single. How Is the Interest Calculated on a Personal Loan? ; 5, $, $ ; 6, $, $ ; 7, $, $ ; 8, $, $ Representative APR applies to loans of £7, – £15, over 2–5 years. Personal loan. Want to know your loan rate? If you have a current account or. Save on higher-rate debt with a fixed interest rate from % to % APR. Flexible Terms. Borrow up to $40, and repay it over 3 to 7 years —. Calculate how much a personal loan might cost for Home improvement loans of £7, or more are available over an extended term of up to 10 years. over the life of the loan. Understanding the Results A personal loan is a short-term, unsecured loan with terms typically ranging from 2 to 5 years. estimate. Credit score range. 3-year fixed rate. 5-year fixed rate. +. %. %. to %. %. to %. %. to Loans are available to UK residents aged 18 and over. Rates will vary depending on loan amount, term and individual circumstances. Subject to status. Tesco Bank.

Companies That Pay Good Dividends

But remember that a dividend is only as good as the company paying it. An Companies typically pay dividends quarterly. But some make special. Such a track record is relatively uncommon among European companies, given the common dividend policy tradition of paying out 50% of earnings. Consequently. These 15 companies have paid out dividends for at least years—and are hoping to continue for a hundred more. As a rule, large, well-established companies are more likely to pay dividends than start-ups or smaller firms. This is because smaller companies often need. Dividend stocks offer regular income to its shareholders. Dividend paying companies are a good investment option for the people who want a regular passive. Typically, stocks that pay dividends are larger, more established companies. And while these firms have the ability to either continue or increase payouts. US companies with the highest dividend yields ; USAC · D · %, USD ; CGBD · D · %, USD ; CSWC · D · %, USD ; OMF · D · %, USD. Dividend stocks are popular among investors because they are typically well-regarded companies with a strong track record of paying reliable dividends. IBM is one of the world's largest computing technology companies and has a history of generating consistent dividends while maintaining high levels of growth. But remember that a dividend is only as good as the company paying it. An Companies typically pay dividends quarterly. But some make special. Such a track record is relatively uncommon among European companies, given the common dividend policy tradition of paying out 50% of earnings. Consequently. These 15 companies have paid out dividends for at least years—and are hoping to continue for a hundred more. As a rule, large, well-established companies are more likely to pay dividends than start-ups or smaller firms. This is because smaller companies often need. Dividend stocks offer regular income to its shareholders. Dividend paying companies are a good investment option for the people who want a regular passive. Typically, stocks that pay dividends are larger, more established companies. And while these firms have the ability to either continue or increase payouts. US companies with the highest dividend yields ; USAC · D · %, USD ; CGBD · D · %, USD ; CSWC · D · %, USD ; OMF · D · %, USD. Dividend stocks are popular among investors because they are typically well-regarded companies with a strong track record of paying reliable dividends. IBM is one of the world's largest computing technology companies and has a history of generating consistent dividends while maintaining high levels of growth.

Dividend paying stocks provide reoccuring income in the form of dividends. Q. What are good dividend paying stocks? A. See Benzinga's list of the best. The Answer is Dividend-Paying Stocks: Building a 'Smart Portfolio' of Good Companies That Pay Stock-Dividends [Beck, David] on martemyanova.ru Check out stocks offering high dividend yields along with the company's dividend history. You can view all stocks or filter them according to the BSE group or. If any company pays a dividend that's more than 50% of net earnings, it's a pretty good sign that sooner or later there will be a reduction in. 9 best dividend stocks · 1. Lowe's · 2. Realty Income · 3. Chevron · 4. Target · 5. Starbucks · 6. Brookfield Infrastructure · 7. Microsoft. Highest Dividend Yield Shares · 1. Taparia Tools, , , , , , , , , , , · 2. C P C L, , Highest Dividend Paying Mega-Cap Stocks ; VZ, Verizon, 1, %, ; PFE, Pfizer, 2, %, I've recently bought FXAIX and some mega 7 company stocks including Nvidia. Although, some pay dividends, its very small amounts. I'd like to know what are. pay high, but not the very highest, level of dividends. Based on the Ned Davis study, it's clear that companies that don't pay dividends or cut their. Dividend Growth Market Leaders. k followers • 10 symbols Watchlist by The Motley Fool. Companies that not only tend to beat the market, but pay you as they. Best Dividend Stocks ; Wells Fargo & Company stock logo. WFC. Wells Fargo & Company. $ +%, 4, ; CVS Health Co. stock logo. CVS. CVS Health. $ + World's companies with the highest dividend yields ; MMLMGL · D · EURONEXT ; VITRO/A · D · BMV ; · D · HKEX ; PPTL · D · ASX. But many overlook another potential source of returns: the dividends that many companies can pay their shareholders. well as your risk tolerance and liquidity. "Dividend payers tend to be big, well-established companies that have Generally speaking, you want to find companies that not only pay steady dividends. Discover the ranking list of the public companies paying the highest dividends. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. Companies typically send dividend payments to the brokerage accounts of their shareholders. Alternatively, a company may not pay a cash dividend, but instead. Companies that pay out a portion of their profits as dividends are known as dividend stocks. This type of stock can serve as a reliable income stream;. When a company pays dividends, it returns some of its profits directly to shareholders, sending a signal to the market of stable and reliable operations. Newer. Top High Dividend Stocks ; Western Midstream Partners, LP (WES). Oil Refining & Marketing MLP. $ ; MPLX LP (MPLX). Oil & Gas - Production and Pipelines.

Tech Stocks Under $1

Best Tech Penny Stocks at a Glance ; Sonim Technologies. NASDAQ: SONM. $ $M · 14 ; Powerbridge Technologies. NASDAQ: PBTS. $ $M · 1. A share is usually classified as a penny stock if it costs less than £1 in the UK or $5 in the US. These companies tend to have market caps below £m in the. NASDAQ: AMST — Amesite Inc — The AI Product Launch Penny Stock; NASDAQ: MLEC — Moolec Science SA — The USDA Approval Fake Meat Penny Stock; NASDAQ: CGC — Canopy. Read more about tech stocks Read more about tech stocks “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license. Looking for the best stocks under $1 to buy in ? MarketBeat has identified 25 low-priced stocks that you should consider for your portfolio. US stocks with low prices in one list: available to a wider range of 1 M USD, —, − USD, +%, %, Electronic technology, —. KTRA Kintara. The Best Tech Penny Stocks · Applied UV · Near Intelligence · Sonim Technologies · Powerbridge Technologies · FOXO Technologies · Mobiquity Technologies · Electra. Below is an analysis of the top tech stocks for September , screened for 1. Best-Value Tech Stocks. Price ($), Market Capitalization ($B), Month. Traded on the NASDAQ Stock Exchange,; Stock price under $1,; Average daily trading volume over 50,, and; Actively traded - securities that have a stock price. Best Tech Penny Stocks at a Glance ; Sonim Technologies. NASDAQ: SONM. $ $M · 14 ; Powerbridge Technologies. NASDAQ: PBTS. $ $M · 1. A share is usually classified as a penny stock if it costs less than £1 in the UK or $5 in the US. These companies tend to have market caps below £m in the. NASDAQ: AMST — Amesite Inc — The AI Product Launch Penny Stock; NASDAQ: MLEC — Moolec Science SA — The USDA Approval Fake Meat Penny Stock; NASDAQ: CGC — Canopy. Read more about tech stocks Read more about tech stocks “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license. Looking for the best stocks under $1 to buy in ? MarketBeat has identified 25 low-priced stocks that you should consider for your portfolio. US stocks with low prices in one list: available to a wider range of 1 M USD, —, − USD, +%, %, Electronic technology, —. KTRA Kintara. The Best Tech Penny Stocks · Applied UV · Near Intelligence · Sonim Technologies · Powerbridge Technologies · FOXO Technologies · Mobiquity Technologies · Electra. Below is an analysis of the top tech stocks for September , screened for 1. Best-Value Tech Stocks. Price ($), Market Capitalization ($B), Month. Traded on the NASDAQ Stock Exchange,; Stock price under $1,; Average daily trading volume over 50,, and; Actively traded - securities that have a stock price.

Stocks Under $10 · Avalo Therapeutics Inc AVTX. Price: $ Daily change: N/A · SmartKem Inc SMTK. Price: $ Daily change: N/A · Outlook Therapeutics Inc OTLK. Top Penny Stocks Today to find best penny stocks to buy for September This list of penny stocks under $1 allowing traders to find hot penny stocks to. 2. Top AI Penny Stocks Under $1 · Remark Holdings, Inc. (NASDAQ: MARK) · Artificial Intelligence Technology Solutions Inc. (OTC: AITX) · martemyanova.ru Best Performing Penny Stocks Under 25 Cents of Sep ; MTLFF Logo, Metallis Resources ; NICLF Logo, Class 1 Nickel and Tech.. ; Glow Lifetech ; 9 Best Penny Stocks Under $1 · 1. GEE Group Inc. · 2. Cybin Inc. · 3. Purple Biotech Ltd. · 4. Pedevco Corp. · 5. Avino Silver & Gold Mines Ltd. · 6. TRX Gold Corp. Penny stocks to buy under $1 · $BTC Digital (martemyanova.ru)$ · $Exela Technologies (martemyanova.ru)$ · $ProQR Therapeutics (martemyanova.ru)$ · $Cybin (martemyanova.ru)$ · $Statera Biopharma . Top Movers ; DELL. DELL. Dell Technologies Inc. Cl C · $ M · ; AVGO. AVGO. Broadcom Inc. $ M · Tech Stocks Under $1 ; MYSZ, ; TAOP, ; GRNQ, ; EGAN, A penny stock, also known as an OTC or Over-The-Counter stock, typically references a stock that trades for less than $5 per share. Penny stocks are often. These returns cover a period from January 1, through August 5, Zacks Rank stock-rating system returns are computed monthly based on the beginning. The top 10 AI Penny Stocks under $1 to buy for good income in that are smart investments · 1. OneConnect Financial Technology Co., Ltd. (NYSE: OCFT) · 2. Tech · Tech · Reviewed · Video Games · Tech But most traders consider stock trading under $5 per share or stocks trading under $1 per share to be penny stocks. The week ended on a sour note following a slightly disappointing employment report with the S&P breaking definitively below its 50d moving average and. Since the stock has just dropped below 1$ there is ample time. Look at the 2 year chart. The last time FGEN dropped hard, was when it dropped to 0,38 and. penny stocks under 1 rs ; 1. Monotype India, ; 2. Sawaca Business, ; 3. Greencrest Finan, ; 4. Adcon Capital, Many penny stocks are from new companies with a micro market cap of under $ million. You can search here for analysts' top-rated penny stocks. Stock Screener Stock Ideas Volatile Penny Stocks. Most Volatile Penny Stocks Today. A list of the most volatile penny stocks listed on the NYSE or NASDAQ. ; DGHI. Top 10 Tech Penny Stocks to Watch · My Size Inc (NASDAQ:MYSZ) · Agm Group Holdings Inc Cl A (NASDAQ:AGMH) · Veritone Inc (NASDAQ:VERI) · Cardlytics Inc (NASDAQ:CDLX). 6 Penny Stocks Under 1 Cent · Metrospaces, Inc. (OTC: MSPC) · The Now Corporation (OTC: NWPN) · Coastal Capital Acquisition Corp. (OTC: CCAJ) · ICOA, Inc. (OTC. Stocks under 1 dollars: Daily Price Predictions of Stocks with Smart Technical Market Analysis.

Calculate Home You Can Afford

The home affordability calculator from martemyanova.ru® helps you estimate how much house you can afford. Quickly find the maximum home price within your price. Knowing how much house you can afford is a matter of comparing your financial situation to the factors lenders consider when approving a mortgage. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. To figure out how much home you can afford with our calculator, enter your gross annual income and total monthly debts, choose a down payment amount and select. How much you can afford to spend on a home depends on several factors, including these primary factors: you and your co-borrower's annual income, down payment. Your loan amount and down payment will determine how much of a home you can afford, but a lender must first determine how much risk they're willing to take on. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines. The home affordability calculator from martemyanova.ru® helps you estimate how much house you can afford. Quickly find the maximum home price within your price. Knowing how much house you can afford is a matter of comparing your financial situation to the factors lenders consider when approving a mortgage. Discover how much house you can afford based on your income, and calculate your monthly payments to determine your price range and home loan options. To figure out how much home you can afford with our calculator, enter your gross annual income and total monthly debts, choose a down payment amount and select. How much you can afford to spend on a home depends on several factors, including these primary factors: you and your co-borrower's annual income, down payment. Your loan amount and down payment will determine how much of a home you can afford, but a lender must first determine how much risk they're willing to take on. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. Our mortgage affordability calculator helps you determine how much house you can afford quickly and easily with the applicable mortgage lending guidelines.

First, do a quick calculation to get a rough estimate of how much you can afford based on your income alone. Most financial advisors recommend spending no more. Here are two common ways to increase how much home you can afford. Reduce your monthly debt. Paying off credit cards or other loans will improve your debt-to-. If you want to do a quick calculation, your monthly mortgage payment should ideally be no more than 25% of your gross income. We can help you plan these next. To calculate your housing budget, start by comparing your monthly earnings to your monthly debt payments. Then you'll determine how much to dedicate toward a. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. How much money do you make each year? Rule of thumb says that your monthly home loan payment shouldn't total more than 28% of your gross monthly income. Gross. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Use the home affordability calculator to help you estimate how much home you can afford. Calculate your affordability. Note: Calculators. Want to know how much house you can afford? Use our home affordability calculator to determine the maximum home loan amount you can afford to purchase. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. Use this calculator to estimate how much house you can afford with your budget. Lenders calculate how much they will lend you to buy a home based on your monthly income minus any fixed, recurring expenses you're obligated to pay. Once you. The question isn't how much you could borrow but how much you should borrow. These home affordability calculator results are based on your debt-to-income ratio. Based on information provided, you may be able to afford a home worth up to $, with a total monthly payment of $1, ; LOAN & BORROWER INFO. Deciding how much house you can afford. If you're not sure how much of your income should go toward housing, start with the 28/36 rule, which dictates you spend. To calculate how much house you can afford, use the 25% rule we talked about earlier: Never spend more than 25% of your monthly take-home pay (after tax) on. How do lenders calculate home affordability? Basic mortgage affordability factors include your monthly income, other debt obligations, and credit score. Your. To calculate this percentage, multiply your gross monthly income by For example, if your gross monthly income is $5,, your housing expenses should not. To determine how much house you can afford, use this home affordability calculator to get an estimate of the home price you can afford based upon your income. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. If you have significant credit card debt or other.