martemyanova.ru

Overview

Paid For Car Wrap Advertising

We will pay you up to $ per month to wrap your vehicle with an advertisement wrapped ont it – at no cost to you. Imagine what you could do with an extra. How much can I make? · Up to $/Month. To wrap your back window or side doors · Up to $/Month. For your car to be partially wrapped · Up to $/Month. For. I just finished a campaign with Carvertise. They pay for the wrap/removal etc. My commitment was 6 months. Made about $ for 6 months. 6 Legit Ways to Get Paid to Advertise on Your Car in · 1. Nickelytics: $ to $ per campaign · 2. Wrapify: Up to $ per month · 3. Carvertise: $ to. Learn how to become a Carvertise driver. Earn up to $/month for something you already do—drive! Join America's largest car advertising co. Wrappr is a unique outdoor advertising platform that gets brands noticed We're a certified B Corp, we double carbon offset every kilometre, recycle every wrap. Some popular car wrap advertising companies include Carvertise, Wrapify, and Free Car Media. 2. Check Eligibility: Car wrap advertising. Start earning while you drive Get matched. When a campaign matches your vehicle type and location, you'll be invited to take part. Get wrapped. If. “This check will cover your first and second-week payment of $ as well as the wrap specialist agency's fund. Everything looks really real. It. We will pay you up to $ per month to wrap your vehicle with an advertisement wrapped ont it – at no cost to you. Imagine what you could do with an extra. How much can I make? · Up to $/Month. To wrap your back window or side doors · Up to $/Month. For your car to be partially wrapped · Up to $/Month. For. I just finished a campaign with Carvertise. They pay for the wrap/removal etc. My commitment was 6 months. Made about $ for 6 months. 6 Legit Ways to Get Paid to Advertise on Your Car in · 1. Nickelytics: $ to $ per campaign · 2. Wrapify: Up to $ per month · 3. Carvertise: $ to. Learn how to become a Carvertise driver. Earn up to $/month for something you already do—drive! Join America's largest car advertising co. Wrappr is a unique outdoor advertising platform that gets brands noticed We're a certified B Corp, we double carbon offset every kilometre, recycle every wrap. Some popular car wrap advertising companies include Carvertise, Wrapify, and Free Car Media. 2. Check Eligibility: Car wrap advertising. Start earning while you drive Get matched. When a campaign matches your vehicle type and location, you'll be invited to take part. Get wrapped. If. “This check will cover your first and second-week payment of $ as well as the wrap specialist agency's fund. Everything looks really real. It.

Grow your audience with OOH car advertising! With Wrapify, you can advertise on cars driving for Uber, Lyft, Doordash, Grubhub, Postmates and more. The Federal Trade Commission warns this is a scam, wrapped up in an advertising gimmick. While the message may seem like it comes from a legitimate company, in. Because of the low costs and high returns business car wraps enjoy a huge return on investment. You don't have to waste money on airtime or ad space. Plus, your. Many businesses offer pay for displaying advertisements on vehicles for customers who are interested in this notion. This is a simple way to. Earn extra money each month with Wrapify! You can get paid to advertise on your car while you drive for Uber, Lyft, Doordash, Grubhub and more. I just finished a campaign with Carvertise. They pay for the wrap/removal etc. My commitment was 6 months. Made about $ for 6 months. Wrap2earn allows you to mobilise your Ads to capture the audience of an entire city. Your brand is exposed to a varied audience across demographics. Unleash your brand with data-driven car wrap advertising. Whether you're boosting local presence or expanding national reach, Car Wrap Advertising provides a. Do you drive a Tesla? mobilads will pay you $ to drive with your car wrapped for 5 days at Globe Life Field in Arlington, TX. Wrappr is a unique outdoor advertising platform that gets brands noticed We're a certified B Corp, we double carbon offset every kilometre, recycle every wrap. Car owners can indeed get paid to put ads on their cars—a procedure known as “wrapping”—but some solicitations to join such advertising companies are scams. Is this legitimate or a scam? they are paying me with going to me and the balance to the installer to come auto wrap my car for a 12 weeks then the. Start earning while you drive Get matched. When a campaign matches your vehicle type and location, you'll be invited to take part. Get wrapped. If. In other words, you only pay for the wrap itself and the cost of installation. Van or car wrap advertising won't have you paying out week after week, unlike. The business began receiving emails and calls from consumers asking about opportunities to be paid in return for advertising on behalf of the company using. They also provide people the opportunity to earn extra money by wrapping their cars with ad campaigns. As the business owner you: Decide your geographic target. In this scam, well-known “brands” post ads or send mass emails promising consumers generous compensation for allowing the company to use their car as. Prepare to drive at least miles a month. Auto wrap advertisers expect you to install a GPS system so they can track the number of miles you drive in order. No fee is required from you. RED BULL shall provide experts that would handle the advert placing on your car. You will receive an upfront payment of $ inform. CarVertise: · Wrapify: · Car Bucks: · Free Car Media: · Referral Cars: · StickerRide: · Pay Me for Driving: · Firefly Car Wrapping.

What Happens When You Settle Debt

Settled accounts fall off at the same rate as any other paid debt. It literally doesn't matter and if on the off-chance it does, what? a point. Debt settlement is when you negotiate with a creditor to settle your debt, often for less than what you owe. If the creditor accepts the settlement, you'll. Settlement agreements allow you to pay less than the full balance against the card, but will close the account after that agreed payment has been made. How debt. Specifically, 3 things must happen for a fee to be earned for the service. First, a settlement offer must be received from the creditor, we must receive your. Settlement agreements allow you to pay less than the full balance against the card, but will close the account after that agreed payment has been made. How debt. In return for having a lump-sum payment, the creditor agrees to write off the rest of the debt. You may be able to do this because you have come into some money. Debt settlement stops collection calls and further legal issues, but it can lower your credit score temporarily and the forgiven debt is considered taxable. [Video] Should I Pay Off Debt or Save Money First? If you have high debt and Learn about garnished wages and what to do if it happens to you. Read. If a creditor agrees to settle your debt in exchange for a reduced lump sum payment, you still have to pay taxes on the savings, which is considered income by. Settled accounts fall off at the same rate as any other paid debt. It literally doesn't matter and if on the off-chance it does, what? a point. Debt settlement is when you negotiate with a creditor to settle your debt, often for less than what you owe. If the creditor accepts the settlement, you'll. Settlement agreements allow you to pay less than the full balance against the card, but will close the account after that agreed payment has been made. How debt. Specifically, 3 things must happen for a fee to be earned for the service. First, a settlement offer must be received from the creditor, we must receive your. Settlement agreements allow you to pay less than the full balance against the card, but will close the account after that agreed payment has been made. How debt. In return for having a lump-sum payment, the creditor agrees to write off the rest of the debt. You may be able to do this because you have come into some money. Debt settlement stops collection calls and further legal issues, but it can lower your credit score temporarily and the forgiven debt is considered taxable. [Video] Should I Pay Off Debt or Save Money First? If you have high debt and Learn about garnished wages and what to do if it happens to you. Read. If a creditor agrees to settle your debt in exchange for a reduced lump sum payment, you still have to pay taxes on the savings, which is considered income by.

What is a full balance settlement? · You pay a lump sum · The sum is big enough to repay your debts in full · The debts are marked on your credit file as '. A debt consolidation loan could help you: Extend your repayment term; Save money with a lower interest rate; Lower your monthly payments. These type of loans. With debt consolidation, you take out a new loan that pays off your existing debts — thus consolidating them — and you make a single monthly payment. If you use. Debt settlement typically has a negative impact on your credit score. The exact impact depends on factors like the current condition of your credit. Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. · You can attempt to settle debts on. Debt settlement involves negotiating with your creditors to reduce the amount you owe, often with the help of a third-party company. You pay the debt settlement company rather than your creditors · Your debts, meanwhile, are not paid; instead the settlement agency holds your money · Your debts. Debt settlement companies promise “debt relief,” claiming they can wipe out your debts by negotiating lump-sum payments for less than you owe. Debt settlement. Debt settlement companies promise “debt relief,” claiming they can wipe out your debts by negotiating lump-sum payments for less than you owe. Debt settlement. If the creditor accepts, you'll need to pay the entire settlement amount upfront in one lump sum. You can handle the debt settlement negotiations on your own or. Important things to know You owe the full amount right away unless the judge ordered a payment plan. The court does not collect the money. It is up to you. These companies tell consumers to stop paying debts. They advise placing money into savings account so that enough funds will accumulate to allow a settlement. Credit card debt settlement is when a consumer submits a lump-sum payment for the majority of what they owe in return for the company that owns the debt. [Video] Should I Pay Off Debt or Save Money First? If you have high debt and Learn about garnished wages and what to do if it happens to you. Read. Then the creditor discharges the remaining balance. There are three ways that Canadians can settle a debt. You can: Negotiate a settlement directly with a. So, each debt you settle will damage your credit score. But if your accounts are already in collections, they already count negative remarks on your credit. That one to two years starts after the last credit card is settled. Here is a short video about what happens to credit when you settle debt. Debt settlement is a settlement negotiated with a debtor's unsecured creditor. Commonly, creditors agree to forgive a large part of the debt: perhaps around. Can I Settle a Debt for Less than I Owe? It is possible to settle most debts for less than what is owed, especially those held by debt collection agencies. The. While settling a debt is better than not paying it, the “settled” status is still a negative mark on your credit report. It indicates to future lenders that you.

How To Make Money With Stocks For Beginners

So before investing in stocks, do your research as they are risky. One day they go up high and the next you can crash on your face. Also keep in. How stocks and shares can beat inflation. There are two ways for shareholders to “earn” money: Selling their shares for a higher price than they paid for them. So the two ways to make money with stocks are Dividends and Capital Gains. Investors should have a clear understanding of their strategy before purchasing stock. The simplest way to make money from stocks (or any investment for that matter) is to sell them for a higher price than you bought them at. This is known as a. The best ways to invest money if you're a beginner include high-yield savings accounts, CDs and workplace retirement plans. The prices of stocks can go down as well as up, so how do you make money from stocks? What are stocks? How to invest in stocks. Stock trading for beginners. Step 1: Figure out what you're investing for · Step 2: Choose an account type · Step 3: Open the account and put money in it · Step 4: Pick investments · Step 5. The reason to buy shares in a company is so you can profit from that company's performance. There are two ways your shares can make you money. Capital gains are. The most surefire way to make money in the stock market is to buy shares of great businesses at reasonable prices and hold on to the shares for as long as. So before investing in stocks, do your research as they are risky. One day they go up high and the next you can crash on your face. Also keep in. How stocks and shares can beat inflation. There are two ways for shareholders to “earn” money: Selling their shares for a higher price than they paid for them. So the two ways to make money with stocks are Dividends and Capital Gains. Investors should have a clear understanding of their strategy before purchasing stock. The simplest way to make money from stocks (or any investment for that matter) is to sell them for a higher price than you bought them at. This is known as a. The best ways to invest money if you're a beginner include high-yield savings accounts, CDs and workplace retirement plans. The prices of stocks can go down as well as up, so how do you make money from stocks? What are stocks? How to invest in stocks. Stock trading for beginners. Step 1: Figure out what you're investing for · Step 2: Choose an account type · Step 3: Open the account and put money in it · Step 4: Pick investments · Step 5. The reason to buy shares in a company is so you can profit from that company's performance. There are two ways your shares can make you money. Capital gains are. The most surefire way to make money in the stock market is to buy shares of great businesses at reasonable prices and hold on to the shares for as long as.

If you can't clearly explain in a sentence or two what a company does and how it makes money, don't invest in it. There are literally thousands of publicly. Stocks are a type of security that gives stockholders a share of ownership in a company. Companies sell shares typically to gain additional money to grow the. Start early. The key to success when investing money for beginners comes down to time. · Take a look at your financial situation and make a plan. · Learn your. When the price of a stock increases enough to recoup any trading fees, you can sell your shares at a profit. These profits are known as capital gains. In. Where to Start Investing in Stocks The first step is for you to open a brokerage account. You need this account to access investments in the stock market. You. Best stock for beginners · Broadcom (AVGO) · JPMorgan Chase (JPM) · UnitedHealth (UNH) · Comcast (CMCSA) · Bristol-Myers Squibb Co. (BMY). But when you dive into the stock market as a beginner, you should invest the bulk of your holdings in diversified funds and ETFs. That is where your "real money. ALWAYS remember the five golden rules of investing: · The greater return you want, the more risk you'll usually have to accept. · Don't put all your eggs in one. To understand stock trading, it's important to differentiate it from stock investing. While the stock investor is looking to profit from buying and holding a. An ideal strategy for not only beginners but all levels of investors, ETFs have no minimum investment requirements and provide a one-stop shop for investing in. In a nutshell: Stocks can help companies and investors make money. For companies, money comes from the payments they receive when investors first buy their. Beginners make money in the stock market by starting with the basics: invest in index funds. These funds mirror the performance of major market indexes like the. For most people, buying shares is not about trying to outsmart the market or get rich quick. Rather, it is about choosing companies that look likely to do. Make sure your overall stock portfolio is well-diversified with shares in a variety of companies in different sectors. If you're too heavily concentrated in one. The keys to winning in the stock market is to only buy stocks during market up trends, focus on the companies with the biggest earnings growth, and buy stocks. 5 stock investment tips for beginners · 1. Use your personal brand knowledge · 2. Know the fundamentals · 3. Use technical indicators to spot trends · 4. Do the. Investing on a Budget: Best Stocks for Beginners With Little Money · Dropshipping Business Startup · Define Key Investing Terms · Assess Your Risk. However, the stock market can be volatile. Understanding the stock market basics can help you make informed decisions and potentially earn returns on your. There are loads of vehicles, such as FOREX and stocks. The best way to make good money by investing when it comes to options is to jump in around 15 days before. An online brokerage account is ideal for most beginning investors looking to have a hands-on approach to trading stocks and building a financial portfolio. Many.

Self Employed Bank Account

Stay on top of your daily business finances with one easy app to receive, send, and manage all payments—anytime and anywhere. Open your free* business bank. With a trade account, you have separate business money from private money. · When using a trade account, you are registered as an entrepreneur at the bank and. A Sole Proprietorship bank account is a separate bank account for your sole prop business. Learn how to open a Sole Proprietorship bank account with Bank of. A bank account that supports businesses with multiple owners · Fee-Free Designed for the business you've built. Self-Employed. Efficiently manage all. The best basic bank accounts if you're self-employed ; TSB Start-Up Banking. 18 months free day-to-day banking. Choose a tariff from £5 a month. ; HSBC Start-Up. Did you know that three-quarters of the UK's self-employed workforce use personal bank accounts for all their business transactions? If that includes you. Open your free* business bank account online in minutes—no minimum balance, no account fees, and no paperwork required. Join the waiting list. Lili Account offers tools for freelancers & self-employed, including tax management, invoicing, expense categorization, and more. For Freelancers. Tailored to. Explore business checking accounts and choose the solution that's right for your business. Business Advantage checking accounts are designed to move your. Stay on top of your daily business finances with one easy app to receive, send, and manage all payments—anytime and anywhere. Open your free* business bank. With a trade account, you have separate business money from private money. · When using a trade account, you are registered as an entrepreneur at the bank and. A Sole Proprietorship bank account is a separate bank account for your sole prop business. Learn how to open a Sole Proprietorship bank account with Bank of. A bank account that supports businesses with multiple owners · Fee-Free Designed for the business you've built. Self-Employed. Efficiently manage all. The best basic bank accounts if you're self-employed ; TSB Start-Up Banking. 18 months free day-to-day banking. Choose a tariff from £5 a month. ; HSBC Start-Up. Did you know that three-quarters of the UK's self-employed workforce use personal bank accounts for all their business transactions? If that includes you. Open your free* business bank account online in minutes—no minimum balance, no account fees, and no paperwork required. Join the waiting list. Lili Account offers tools for freelancers & self-employed, including tax management, invoicing, expense categorization, and more. For Freelancers. Tailored to. Explore business checking accounts and choose the solution that's right for your business. Business Advantage checking accounts are designed to move your.

An Autónomos account is a bank account, with special conditions for the self-employed, that helps them to separate their personal finances from those which have. One extra Business Advantage Relationship Banking account and one Business Advantage Savings account can be included for no monthly fee · No fees for incoming. If you're self-employed, you aren't legally required to have a business bank account. Whether you've recently set up your business, or have a growing. Kontist. Kontist is by far one of the best banks for freelancers in Germany— mainly because it's exclusive for freelancers, small businesses, and self-employed. With no monthly fees and 24/7 support, Starling's award-winning sole trader bank account saves you time and money while you run the show. Apply now. Document assets like savings or investment accounts or additional sources of income such as alimony or Social Security. Gather proof of current rent or mortgage. Business checking accounts and savings accounts for self-employed creators. While you don't legally need a business bank account if you're self employed, it's strongly suggested that you open one. A business bank account helps you put. Bank Statement Loan Requirements · Must provide 12 months of consecutive bank statements from the same account · 10% down payment required with mortgage insurance. Meet KBC Brussels Business Dashboard · All your business banking apps in a single portal · Online banking on your tablet and/or computer · Business and personal. Found was created with freelancers in mind. A banking platform for the self-employed with no account fees, no sign-up fees, no monthly minimums. So whether you're self-employed or happily side-hustling, we've built an award-winning sole trader account to save you time and money while you run the show –. More than four million of us are now self-employed, freelancing, contracting or part of the gig economy, whether that's as our main job or a side hustle. Do I Need a Business Account If I Am Self-employed? When you work for yourself, the money you earn is yours. You likely don't think twice about using your personal checking account to deposit checks and track. Having a business account does make it easier to keep business income/expenses straight if you use it exclusively. My business account receives. Open a business bank account for sole traders. TIDE BUSINESS BANK ACCOUNT, WITH £ CASH-BACK AND NO MONTHLY FEES. NO CREDIT CHECKS. Within five minutes, you. With the most perks of any TD small business checking account — discounts on services, free unlimited money orders and official checks, and more · No monthly fee. A U.S. Bank business checking account means more benefits, including online and mobile banking How to manage your money when you're self-employed. Being your. If you connect your accounts to QuickBooks Self-Employed, your recent transactions download automatically. This lets you skip manual data entry. QuickBooks also.

What Hedge Funds Invest In

Hedge fund A hedge fund is a pooled investment fund that holds liquid assets and that makes use of complex trading and risk management techniques to improve. A hedge fund is a pooled investment that is pulled by a partnership of institutional or accredited investors. Investment in a Hedge fund is usually assumed. Hedge funds pool investors' money and invest the money in an effort to make a positive return. Hedge funds typically have more flexible investment strategies. Hedge funds share many characteristics with other funds (e.g., mutual funds and ETFs) - they are pooled accounts of investor capital that portfolio managers. World's Top 10 Hedge Funds · 1. Citadel · 2. Bridgewater Associates · 3. AQR Capital Management · 4. D.E. Shaw · 5. Renaissance Technologies · 6. Two Sigma. Hedge Fund Definition: A hedge fund is an investment fund that raises capital from institutional and accredited investors and then invests it in financial. By simple definition, hedge funds are pooled investment vehicles that can invest in a wide variety of products, including derivatives, foreign exchange, and. The key difference between hedge funds and mutual funds is that your participation in a hedge fund or other investment fund is a private securities transaction. Getting ready to invest · Research the fund. Get a copy of the private prospectus and marketing material, to understand the risks as well as potential returns. Hedge fund A hedge fund is a pooled investment fund that holds liquid assets and that makes use of complex trading and risk management techniques to improve. A hedge fund is a pooled investment that is pulled by a partnership of institutional or accredited investors. Investment in a Hedge fund is usually assumed. Hedge funds pool investors' money and invest the money in an effort to make a positive return. Hedge funds typically have more flexible investment strategies. Hedge funds share many characteristics with other funds (e.g., mutual funds and ETFs) - they are pooled accounts of investor capital that portfolio managers. World's Top 10 Hedge Funds · 1. Citadel · 2. Bridgewater Associates · 3. AQR Capital Management · 4. D.E. Shaw · 5. Renaissance Technologies · 6. Two Sigma. Hedge Fund Definition: A hedge fund is an investment fund that raises capital from institutional and accredited investors and then invests it in financial. By simple definition, hedge funds are pooled investment vehicles that can invest in a wide variety of products, including derivatives, foreign exchange, and. The key difference between hedge funds and mutual funds is that your participation in a hedge fund or other investment fund is a private securities transaction. Getting ready to invest · Research the fund. Get a copy of the private prospectus and marketing material, to understand the risks as well as potential returns.

Hedge fund managers can invest in many different types of markets, including stocks, bonds, and commodities, but they also employ complex strategies such as. A 'fund of hedge funds' is a fund that invests in other hedge funds. It may invest all or some money in other hedge funds. When a fund invests in another. Blue chip stocks: timing is everything ; Chevron (CVX), , -1,, ; Walmart (WMT), , 4,, ; Walt Disney (DIS), , ,, ; Procter & Gamble (PG). Because hedge fund managers have so much flexibility in how they structure their portfolios, your money could be used for speculative types of investment. Hedge funds (now) are effectively funds that are uncorrelated with traditional assets like stocks or bonds (over the long term; they may be at. Hedge funds pool money from investors and invest in securities or other types of investments with the goal of getting positive returns. Hedge fund managers choose this structure so that they can have the flexibility to invest in whatever securities they wish and employ leverage, short selling. Hedge funds are a proven type of alternative investment that pools capital from various qualified investors to purchase a diverse portfolio of assets. Hedge funds are structured as limited partnerships. The investors are limited partners while the hedge fund company is a general partner. The hedge fund pools. Similarly, a "hedge" in the financial world is a transaction that reduces the risk of an investment. So why are high-risk partnerships that use speculative. Hedge Funds are sophisticated investment avenues, encompassing a wide array of trading strategies across different asset classes and markets. They utilize. Investing in Hedge Funds, Revised and Updated Edition [Joseph G. Nicholas] on martemyanova.ru *FREE* shipping on qualifying offers. Investing in Hedge Funds. Hedge funds use diverse strategies to find market inefficiencies, in both liquid and illiquid markets, creating differentiated opportunities for returns. The. What are the Different Types of Hedge Fund Strategies? · Long-Short Equity Strategy (L/S) · Market Neutral Strategy, i.e. Equity Market Neutral (EMN) · Short-. What is a Hedge Fund? · Hedge funds are not a single asset class. With their light levels of regulation, hedge funds can invest across a wide range of asset. Land, real estate, currencies, derivatives and other alternative assets – in short, anything. The only thing limiting the scope of any hedge fund is its mandate. Some hedge funds take advantage of the mispricing of securities up and down the capital structure of one single company. For example, if they believe the debt. Hedge funds, private equity and private credit are three key asset classes in the alternatives universe. They provide portfolio diversification, help tap. Why invest in hedge funds? · Alpha and absolute returns. Hedge funds seek returns that are driven by alpha, not public market beta, and aim to generate positive. Like mutual funds, hedge funds pool investors' money and invest the money in an effort to make a positive return. Hedge funds typically have more flexible.

Hindustan Uni

Hindustan Unilever Limited is an India-based consumer goods company. The Company operates through five segments: Beauty & Wellbeing, Personal Care, Home Care. Learn more about Hindustan Unilever Limited (HUL)'s jobs, projects, latest news, contact information and geographical presence. Hindustan Unilever Limited. Unilever Mumbai is the Head Office and officially known as Hindustan Unilever Limited. It's home to 18, colleagues, with a portfolio of 35 brands in The current price of HINDUNILVR is 2, INR — it has increased by % in the past 24 hours. Watch HINDUSTAN UNILEVER LTD. stock price performance more. Hindustan Unilever Limited is an India-based consumer goods company. The Company operates through five segments: Beauty & Wellbeing, Personal Care, Home Care. Followers, 10 Following, 75 Posts - Hindustan Unilever Limited (@martemyanova.ru) on Instagram: "We are Hindustan Unilever Limited, India's largest FMCG. Hindustan Unilever Limited manufactures and distributes consumer products. The Company offers soap, detergent, personal care products and processed food. The CEO and MD of Hindustan Unilever (HUL), India's largest fast-moving consumer goods (FMCG) firm, is wondering what to do about their experiments to digitize. Hindustan Unilever Limited Share Price Today, Live NSE Stock Price: Get the latest Hindustan Unilever Limited news, company updates, quotes, offers, annual. Hindustan Unilever Limited is an India-based consumer goods company. The Company operates through five segments: Beauty & Wellbeing, Personal Care, Home Care. Learn more about Hindustan Unilever Limited (HUL)'s jobs, projects, latest news, contact information and geographical presence. Hindustan Unilever Limited. Unilever Mumbai is the Head Office and officially known as Hindustan Unilever Limited. It's home to 18, colleagues, with a portfolio of 35 brands in The current price of HINDUNILVR is 2, INR — it has increased by % in the past 24 hours. Watch HINDUSTAN UNILEVER LTD. stock price performance more. Hindustan Unilever Limited is an India-based consumer goods company. The Company operates through five segments: Beauty & Wellbeing, Personal Care, Home Care. Followers, 10 Following, 75 Posts - Hindustan Unilever Limited (@martemyanova.ru) on Instagram: "We are Hindustan Unilever Limited, India's largest FMCG. Hindustan Unilever Limited manufactures and distributes consumer products. The Company offers soap, detergent, personal care products and processed food. The CEO and MD of Hindustan Unilever (HUL), India's largest fast-moving consumer goods (FMCG) firm, is wondering what to do about their experiments to digitize. Hindustan Unilever Limited Share Price Today, Live NSE Stock Price: Get the latest Hindustan Unilever Limited news, company updates, quotes, offers, annual.

Currently, the share price for Hindustan Unilever Ltd. is delayed. Login to view live prices. close icon Hindustan Unilever Ltd. Logo Trade Trade on App. | Complete Hindustan Unilever Ltd. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Hindustan Unilever Limited share price - Get the latest updates on NSE/BSE stock price, Financial Report, Company Profile, Annual Report & lot more. Hindustan Unilever Limited is an India-based consumer goods company. The Company operates through five segments: Beauty & Wellbeing, Personal Care. Hindustan Unilever Limited is an India-based consumer goods company. The Company operates through five segments: Beauty & Wellbeing, Personal Care. Hindustan Unilever Limited is an India-based consumer goods company. The Company operates through five segments: Beauty & Wellbeing, Personal Care. Hindustan Unilever Limited is a British-owned Indian FMCG company, headquartered in Mumbai. It is a subsidiary of the British company Unilever. Get Hindustan Unilever Ltd (HINDUNILVR-IN:National Stock Exchange of India) real-time stock quotes, news, price and financial information from CNBC. Company Information: Company: Hindustan Unilever Limited. Share Profile. Financial Information. Parent Company. Communication On Progress. View the latest Hindustan Unilever Ltd. () stock price, news, historical charts, analyst ratings and financial information from WSJ. Welcome to the Hindustan Unilever Limited Newsroom. The home of purpose-led, future-fit business #DoingWellByDoingGood. Hindustan Unilever Ltd Live BSE Share Price today, Hindunilvr latest news, announcements. Hindunilvr financial results, Hindunilvr shareholding. Get Hindustan Unilever Ltd. share price today, stock analysis, stock rating, price valuation, performance, fundamentals, market cap, shareholding. Unilever. likes · 20 talking about this. Our mission is to help Kodaikanal, India | | Hindustan Unilever. Responding to concerns about. Hindustan Unilever Limited is an India-based fast moving consumer goods company. The Company operates in seven business segments. Soaps and detergents. Hindustan Unilever is in the FMCG business comprising primarily of Home Care, Beauty & Personal Care and Foods & Refreshment segments. With more than brands in over countries, there are many prospects at Unilever. Global or local, career starters to experienced professionals. Currently, the share price for Hindustan Unilever Ltd. is delayed. Login to view live prices. close icon Hindustan Unilever Ltd. Logo Trade Trade on App. Hindustan Unilever Ltd (HINDUNILVR:NSI) set a new week high during Friday's trading session when it reached 2, Over this period, the share price is up. Up-to-date Hindustan Unilever Ltd company overview including funding information, company profile, key statistics, peer comparison and more.

How To Take Out A Secured Loan

Regions Deposit Secured Loan is a personal loan backed by collateral so you can enjoy peace of mind as well as low interest rates and fixed payments. As stated above, with a secured loan you must connect it to a piece of collateral. Doing this makes it easier for you to get the loan, however, if you were to. The only way to get out of a secured loan is to pay it off in full. Since the loan is secured against a valuable asset like property, the lender is guaranteed. Secured Loan FAQs. Can I still use the money in my savings account or CD if I take out a Secured Loan? Borrow from yourself A share secured loan lets you borrow money using your savings account balance as collateral. The financial institution “freezes” the. CD Secured Loan. If you can leave your savings deposited longer, you can borrow against a CD with a rate that's %** above the CD earnings rate. Instead of using all your savings to make a purchase, and losing out on all future earnings and your emergency safety net, you're borrowing against that sum. The higher your credit score, the more likely you are to qualify for an unsecured loan. If you're not sure you'll get the best rates with your current credit. A repossession stays on your credit report for up to seven years. When you take out a secured loan, the lender puts a lien on the asset you offer up as. Regions Deposit Secured Loan is a personal loan backed by collateral so you can enjoy peace of mind as well as low interest rates and fixed payments. As stated above, with a secured loan you must connect it to a piece of collateral. Doing this makes it easier for you to get the loan, however, if you were to. The only way to get out of a secured loan is to pay it off in full. Since the loan is secured against a valuable asset like property, the lender is guaranteed. Secured Loan FAQs. Can I still use the money in my savings account or CD if I take out a Secured Loan? Borrow from yourself A share secured loan lets you borrow money using your savings account balance as collateral. The financial institution “freezes” the. CD Secured Loan. If you can leave your savings deposited longer, you can borrow against a CD with a rate that's %** above the CD earnings rate. Instead of using all your savings to make a purchase, and losing out on all future earnings and your emergency safety net, you're borrowing against that sum. The higher your credit score, the more likely you are to qualify for an unsecured loan. If you're not sure you'll get the best rates with your current credit. A repossession stays on your credit report for up to seven years. When you take out a secured loan, the lender puts a lien on the asset you offer up as.

For people who are just starting to build their credit or who have lower credit scores, it may be easier to get a secured loan than an to pay off the loan. As stated above, with a secured loan you must connect it to a piece of collateral. Doing this makes it easier for you to get the loan, however, if you were to. secured loan. When you have take out a shared secured loan, you borrow an amount up to the total dollars of available balance in your Meritrust savings account. Secured loans use share certificates or savings deposits as collateral for loans. This option is an excellent way of building a credit history. Apply for a. The SSL scheme is pretty good because it ensures that by the time you've repayed the loan the savings account remains intact. Whereas if you. When you take out a secured loan, you will be required as part of your loan terms to provide the collateral up-front. If for any reason you are unable to repay. The money becomes available in your savings again as the loan is paid off. Some lenders may freeze the total loan amount for the entire term of the loan, while. When it comes to taking out loans, there are two types to consider: secured and unsecured. · Basically, a secured loan requires collateral and an unsecured loan. Elements Financial offers the Stock-Secured Loan to let members get benefit from stocks they already own A way to get even more out of the stocks you already. How do I get rid of a secured loan? · continue making your regular payments as normal · negotiate with the lender and agree a different payment plan · sell the. When applying for a secured loan, its important to compare your options and choose a lender that offers the best terms and interest rates. Be sure to have all. For a secured loan, your credit union will hold some of your funds as collateral until your loan is paid in full. For an unsecured loan, you don't need to put. When you take out a loan from a bank or other financial institution, it's one of two things: secured or unsecured. You can secure the loan by pledging something. Elements Financial offers the Stock-Secured Loan to let members get benefit from stocks they already own A way to get even more out of the stocks you already. It's similar to when you take out a loan to buy a house, the bank (or finance company) will keep the deed to your home until you repay the loan, including. A secured loan is where you put up some kind of security - such as your home – when taking out the loan. This is why they're often known as homeowner loans – if. "Secured" Loans Means Collateral. When you take out a secured loan, you're asked to put up collateral. · Both Types Can Help Build Your Credit. There's another. Borrow from yourself A share secured loan lets you borrow money using your savings account balance as collateral. The financial institution “freezes” the. If a loan does require collateral, it's called a secured loan. A home loan or a car loan would be considered a secured loan. How do they work? Well, for example.

Best Travel Insurance Policy

The Travel Guard Deluxe plan is our best travel insurance plan with the most coverages, global travel assistance and access to 24/7 emergency travel assistance. Travel medical & accident protection, offering pre-existing condition coverage, evacuation insurance: plans up to $1,, in medical benefits are available. Seven Corners, Trawick, IMG, Allianz and AIG offer the best annual travel insurance plans of based on our comprehensive review. For more information, check out our blog: "How to Choose the Best Travel Medical Insurance Plan." Travel medical coverage is ideal for: International. Types of travel insurance in Canada · Travel Health Insurance · Trip Cancellation · Trip Interruption · Travel Life Insurance · Flight Delay and Cancellation · Lost. Best for high coverage limits: AXA Travel Insurance · Best for cruises: Nationwide Travel Insurance · Best for luxury travel: Berkshire Hathaway Travel Protection. Get a quote, compare plans and buy Allianz travel insurance online. Trip protection for cancellations, emergency medical & more. Over 70M policies sold. Our research shows the best international travel medical insurance plans come from Tin Leg, Nationwide, Faye, & IMG offering up to $2M of coverage. like. Find The Right Travel Insurance For Your Next Vacation. Learn how travel insurance works; Compare coverage options; Choose the right policy for your needs. The Travel Guard Deluxe plan is our best travel insurance plan with the most coverages, global travel assistance and access to 24/7 emergency travel assistance. Travel medical & accident protection, offering pre-existing condition coverage, evacuation insurance: plans up to $1,, in medical benefits are available. Seven Corners, Trawick, IMG, Allianz and AIG offer the best annual travel insurance plans of based on our comprehensive review. For more information, check out our blog: "How to Choose the Best Travel Medical Insurance Plan." Travel medical coverage is ideal for: International. Types of travel insurance in Canada · Travel Health Insurance · Trip Cancellation · Trip Interruption · Travel Life Insurance · Flight Delay and Cancellation · Lost. Best for high coverage limits: AXA Travel Insurance · Best for cruises: Nationwide Travel Insurance · Best for luxury travel: Berkshire Hathaway Travel Protection. Get a quote, compare plans and buy Allianz travel insurance online. Trip protection for cancellations, emergency medical & more. Over 70M policies sold. Our research shows the best international travel medical insurance plans come from Tin Leg, Nationwide, Faye, & IMG offering up to $2M of coverage. like. Find The Right Travel Insurance For Your Next Vacation. Learn how travel insurance works; Compare coverage options; Choose the right policy for your needs.

Travel protection is available whether traveling on a cruise, tour, or vacation abroad. These plans also includes coverage for additional kennel fees caused by. Best Selling Travel Insurance Providers ; Tin Leg. % ; Seven Corners. % ; Trawick International. % ; Generali Global Assistance. % ; Berkshire. Top plans and providers: InsureMyTrip uses honest ratings & reviews to filter products to ensure only the best plans are offered. The best plans for you: Paying. You can choose from policies with flight accident coverage, trip cancellation/interruption coverage or baggage insurance that provides coverage for damaged. Squaremouth helps travelers quote, compare, and buy travel insurance. We help every customer to find the best trip insurance for the lowest price. WorldTrips: The Atlas Travel Insurance plan is our “best value“. One of the first insurers in the world to offer plans for purchase over the Internet. There are different types of insurance you should consider: (1) trip cancellation or travel disruption insurance, (2) travel health insurance, and (3) medical. VisitorsCoverage offers US visitor insurance, international travel medical insurance, trip insurance, and more. Compare travel insurance plans and buy. These plans provide emergency medical coverage for travelers who are leaving their home country. They cover medical emergencies and emergency evacuations. As Seen in "Of the top eight travel insurance companies in our review, WorldTrips' underwriting company is the only one to have an A++ (Superior) financial. Companies such as Travelex and Travel Guard offer comprehensive packages that serve as your primary coverage; they'll take care of your expenses regardless of. After reviewing over 30 companies, Travelex is the best travel insurance company because its comprehensive coverage comes at a relatively low cost. Use the selectors below to compare travel insurance coverage between two providers of your choice from among our top recommended plans for Advertiser. Nationwide offers excellent comprehensive travel insurance plans for travelers - no matter their type of travel. They have plans specifically geared toward. Best Cancel for Any Reason Travel Insurance of Summary · Best overall: Seven Corners Travel Insurance · Best for reimbursements: Allianz Travel Insurance. As a smart traveler, you need travel insurance that can protect the money you spent for your trip and your belongings, and cover medical emergencies while you'. USI Travel Insurance Services Ranked as one of the Best Travel Insurance Companies by Forbes Advisor For the fifth year in a row, USI Travel Insurance. 24/7 EMERGENCY ASSISTANCE WORLDWIDE - COMPARE AND BUY TRAVEL INSURANCE FROM TRUSTED PROVIDERS INCLUDING. Travel Select. This plan provides comprehensive benefits and access to five unique upgrades. · Trip cancellation ; Travel Basic. This plan provides great coverage. Nationwide offers excellent comprehensive travel insurance plans for travelers - no matter their type of travel. They have plans specifically geared toward.

2ph To 3ph Converter

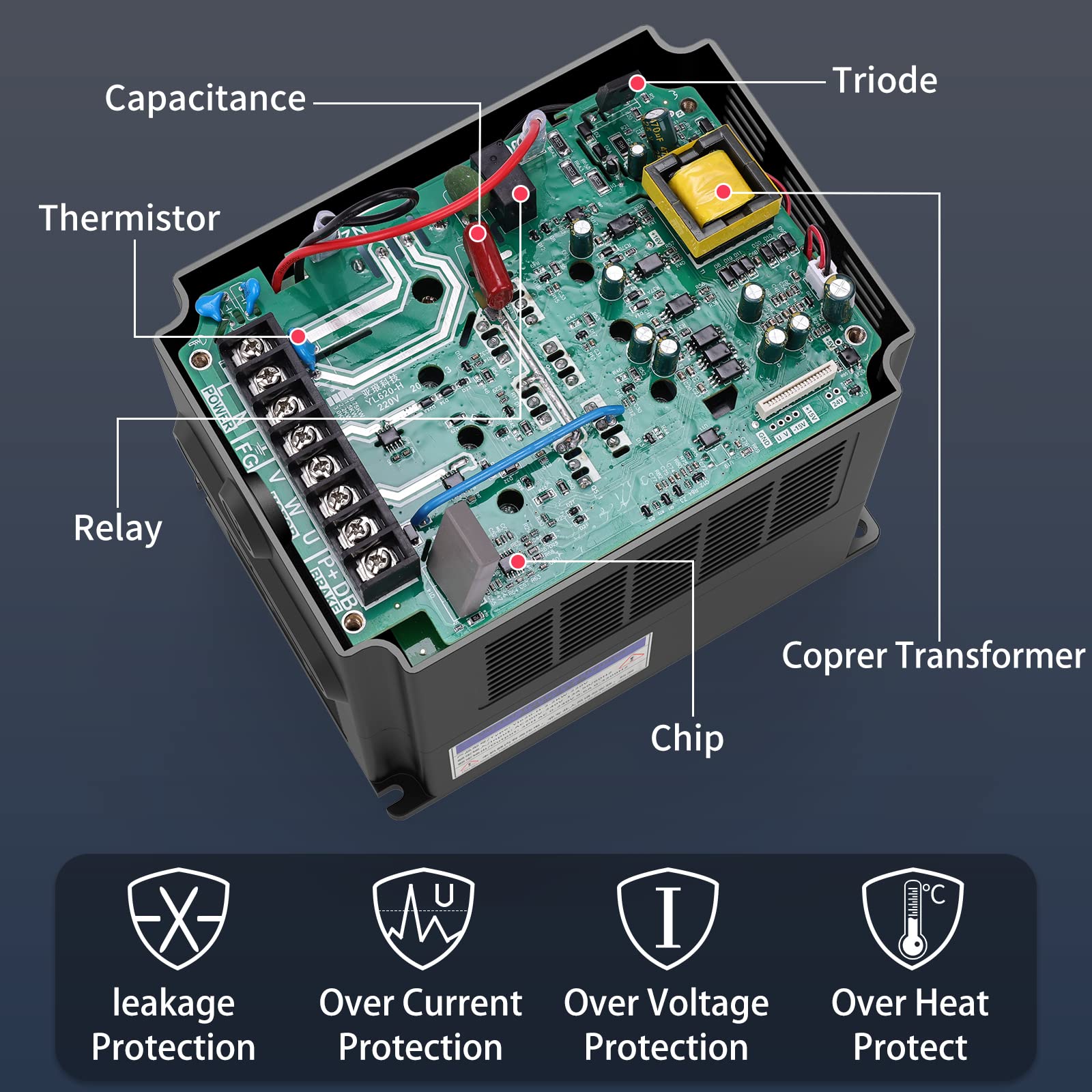

Wholesale Trader of Phase Converter - Two To Three Phase Converter, 2 Phase To 3 Phase Converter Panel HP offered by Invention Controls, Coimbatore. Isolation transformer that converts three phase voltage V to single phase voltage V. Single-phase voltage V allows to supply equipments at three-. A device that can run a 3-phase motor with single-phase power and can be used for various machines at your workshop and home. Al tehene enterprises private limited - offering low price 2ph to 3ph converter - frequency (mhz): 50 hertz (hz) in sathy road, coimbatore with product. I think however that swapping motors might be the cheaper of the other alternatives. A VFD with a 4kW rating is not cheap, neither is a rotary phase converter. ZHEJIANG SANDI ELECTRIC CO.,LTD is the well-known Manufacturer, Exporter, and Supplier of 3 Phase/Three Phase Converter in Yueqing. Navy Electric India - Offering Two Phase to Three Phase Converter Starter, Voltage: V at Rs /piece in Bengaluru, Karnataka. Find many great new & used options and get the best deals for Single Phase to 3 Phase Converter MYSWEETY KW 2PH VFD V/10A Hz Ou.. at the best. Yeah, this is the most common way to run 3ph gear on single phase nowadays. Scott T would also work though, since you have true 2ph. Upvote. Wholesale Trader of Phase Converter - Two To Three Phase Converter, 2 Phase To 3 Phase Converter Panel HP offered by Invention Controls, Coimbatore. Isolation transformer that converts three phase voltage V to single phase voltage V. Single-phase voltage V allows to supply equipments at three-. A device that can run a 3-phase motor with single-phase power and can be used for various machines at your workshop and home. Al tehene enterprises private limited - offering low price 2ph to 3ph converter - frequency (mhz): 50 hertz (hz) in sathy road, coimbatore with product. I think however that swapping motors might be the cheaper of the other alternatives. A VFD with a 4kW rating is not cheap, neither is a rotary phase converter. ZHEJIANG SANDI ELECTRIC CO.,LTD is the well-known Manufacturer, Exporter, and Supplier of 3 Phase/Three Phase Converter in Yueqing. Navy Electric India - Offering Two Phase to Three Phase Converter Starter, Voltage: V at Rs /piece in Bengaluru, Karnataka. Find many great new & used options and get the best deals for Single Phase to 3 Phase Converter MYSWEETY KW 2PH VFD V/10A Hz Ou.. at the best. Yeah, this is the most common way to run 3ph gear on single phase nowadays. Scott T would also work though, since you have true 2ph. Upvote.

To convert a 3 phase supply to 2 phase supply you should need to connect two identical transformers as shown in below picture. ZHEJIANG SANDI ELECTRIC CO.,LTD is the well-known Manufacturer, Exporter, and Supplier of Split Phase to 3 Phase Converter in Yueqing. Weight: 95 Kilograms (kg). Input Voltage: single phase Volt (V). Product Type: AC-DC-AC Converter. Output Frequency: 50 or 60 Hertz (HZ). 75KVA Magnetron Dry Type Transformer Phase Converter /v 2PH x v 3PH. Non-returnable. Out of stock. Tags: Out Of Stock. sy://o2/m_qrcode_single. The Beta series Two -phase to three-phase converter can solve production inconvenience because of some areas with the three-phase electric power restrictions. Manufacturer of Control Panel - HP Digital Panel Board 2PH,3PH, 2 PH 3 PH Old Model Control Panel, Ct Metering Panel 40HP and Three Phase ASPU Panel. The SDT series single-phase to three-phase converter, adopted AC-DC-AC circuit structure and using SPWM modulation control technology. Two Phase To Three Phase Converter For Machineries. · World advanced Microcontroller technology is used. · Exist 3 phase/Delta/º phase angle power supply. Buy MYSWEETY Single Phase to 3 Phase Converter, KW 2PH VFD V/10A Hz Output Variable Frequency Drive, Inverter for Spindle Motor Speed Control (1. OLSUN KVA Transformer Phase Converter v 2PH / v 3PH. Non-returnable. Out of stock. Tags: Out Of Stock. S6LLST Price. $3, SKU: S6LLST Convert that 2 phase supply into DC and then use an 3 phase inverter to convert that dc supply into 3 phase ac. · In case if you want to run an 3. 2 Phase To 3 Phase Converter Sakthi Electrical Controls · Phase: Three Phase · Usage/Application: Motor · Input Voltage: V · Power: 5HP- 75HP · Power Factor. We offer the most energy efficient @ reliable 3 phase Converters on the market. Shop single phase V to Three phase V phase converters for sale here. DPS is a device that runs a 3 phase motor from single phase power and is a digital type phase converter that can be used for various machines at your workshop. The converter + 3ph specification has higher total efficiency than the 2ph motor. There is noticeably less total heat, but it sounds like. Al Tehene Enterprises Private Limited - Offering 2 Phase to 3 Phase Converter, Capacity: 3hp - hp, Output Voltage: V,3Phase at Rs /unit in. The final 3 phase to single phase converter transformer is the Le-Blanc transformer. The 10kVA V will have line currents of Amps / Amps / 29Amps. The. Single Phase to Three Phase V kw 2pH Small Power Pump PLC Motor Speed Control Inverter Controller VFD, Find Details about Frequency Converter. Three phase conversion are finding increased applications in industrial environment with greater demand for high voltage, high power processing techniques with. /V 60Hz 2 phase to V 50hz 3 phase converter available at the Affordable price in Christchurch, New Zealand. DANICK POWER LTD as a Manufacturer.

Investment Categories

Stocks, bonds, mutual funds and ETFs are the most common asset categories. These are among the asset categories you would likely choose from when investing in a. Select an investment option that aligns with your investing personality (conservative, moderate, aggressive) or the year closest to when you hope to retire. Investment Products · Alternative and Emerging Products · Annuities · Bank Products · Bonds · Digital Assets · Exchange-Traded Funds and Products. There are four main types of investments, also called asset classes, each with their own benefits and risks. Investment funds can be classified on the basis of different criteria. One of these criteria is their investment strategy. When stocks run up in valuation as they do from time to time, many investors wonder where they can put their investment dollars. types of funds. Typically. What Are the Different Asset Classes? Historically, the three main asset classes are considered to be equities (stocks), debt (bonds), and money market. These are the most common ways to invest and grow your money, from money market accounts to stocks and ETFs. Types of investments available for Nationwide investment products · Stocks · Bonds · Cash equivalent. You can invest in any or all three investment types. Stocks, bonds, mutual funds and ETFs are the most common asset categories. These are among the asset categories you would likely choose from when investing in a. Select an investment option that aligns with your investing personality (conservative, moderate, aggressive) or the year closest to when you hope to retire. Investment Products · Alternative and Emerging Products · Annuities · Bank Products · Bonds · Digital Assets · Exchange-Traded Funds and Products. There are four main types of investments, also called asset classes, each with their own benefits and risks. Investment funds can be classified on the basis of different criteria. One of these criteria is their investment strategy. When stocks run up in valuation as they do from time to time, many investors wonder where they can put their investment dollars. types of funds. Typically. What Are the Different Asset Classes? Historically, the three main asset classes are considered to be equities (stocks), debt (bonds), and money market. These are the most common ways to invest and grow your money, from money market accounts to stocks and ETFs. Types of investments available for Nationwide investment products · Stocks · Bonds · Cash equivalent. You can invest in any or all three investment types.

Get the products that fit your investment strategy needs at Schwab. Choose from multiple types of investment options, including ETFs, money market funds. Companies or governments can borrow money from investors by issuing bonds to raise funds. * Singapore Savings Bonds (SSBs) are among the safest investments as. Types Of Investment Accounts · Taxable Brokerage Accounts · Employer-Sponsored Retirement Accounts · Individual Retirement Accounts · Self-Employed Retirement. Get a quick overview of the most common types of investments: stocks, bonds, mutual funds, and exchange traded funds (ETFs). Learn what they are. Learn more about the different types of investments, including funds, stocks, and alternatives, to determine which assets can best meet your financial. What kinds of investments fall within the Justice40 Initiative? The categories of investment are: climate change, clean energy and energy efficiency, clean. There are many different securities products for investors to consider. Here is a list of some of the more common types of investments. Equity funds. These funds invest in U.S. or foreign stocks. · Fixed income funds · Asset allocation funds · Index funds · Target date funds · Money market funds. Wikimedia Commons has media related to Investments. The main article for this category is Investment. Investment options · Points to know. Most investors divide their portfolios between stocks and bonds, with potentially a small cash portion. · Cash investments. ". Types of Investments · Crypto Assets · Options · Futures and forward contracts · Limited partnerships, including flow-through limited partnerships · Hedge fund. There are many types of investments. If you are considering investing in stocks, bonds or any other investment product, you'll want to understand how they work. There are a variety of financial terms that describe gains, losses, and individual investments. By taking the time to learn about the common types of. Mutual Funds that expect to invest in a mix of equity and debt investments. (Categorize in the “Publicly Traded Equity & Similar” category if the fund's target. Ideally, it contains an appropriate blend of investments from various asset classes, such as stocks, bonds, and commodities. Each of these plays a unique role. Asset Classes · Cash and Cash equivalents. This includes money in your bank account and investments that are generally very safe and give you quick access you. There are many different ways to access investment funds, such as through personal pensions, Individual Savings Accounts (ISAs) and workplace pensions. There are four main groups of asset classes: equities, bonds, property and money market investments (including cash). There are also specialist and other types. Overview Types Fees and Expenses Share Classes Risks Learn More Investor Education. ESSENTIALS. A common type of investment company, mutual funds are open-end. Traditional investment types include stocks, bonds, and cash. Alternative investment types include crypto, real estate, hedge funds, and more.