martemyanova.ru

News

Fun Jobs For 13 Year Olds

Finding a job can be an exciting, but scary process. Here you'll find some resources to help you in your search. Find Jobs and Internships. Youth Employment. A job at your local movie theater is always a great option. Teens may apply for just the Summer or for the school year. There are several movie theaters located. Jobs for 13 Year Olds That Pay · Technology Guru Services · Pet Sitting and Walking · Babysitting in the Neighborhood · Mowing and Other Yard Work · Neighborhood. Summer movie releases make working at the theater a fun option. This is a great job any time of the year. There are several movie theaters located throughout. Age 13 and My year-old has autism and will need before-school (put on the bus) and after-school (pick up off the bus) care. I will also need someone. Jobs & Careers. Jobs & Careers · Find a Job · Career Development You will need working papers if you are under 18 years old. Working papers. job for 13 year old jobs in new york, ny · RN / LPN - Private Duty Nursing Homecare. Greater New York Nursing Services —Manhattan, NY. No supplemental O2 needed. My very own first job as a 12 year old was, yup, you guessed it, babysitting! It was for a kid who lived next door. And luckily for me, he was an easy kid to. Jobs for 13 Year Olds That Pay · Technology Guru Services · Pet Sitting and Walking · Babysitting in the Neighborhood · Mowing and Other Yard Work · Neighborhood. Finding a job can be an exciting, but scary process. Here you'll find some resources to help you in your search. Find Jobs and Internships. Youth Employment. A job at your local movie theater is always a great option. Teens may apply for just the Summer or for the school year. There are several movie theaters located. Jobs for 13 Year Olds That Pay · Technology Guru Services · Pet Sitting and Walking · Babysitting in the Neighborhood · Mowing and Other Yard Work · Neighborhood. Summer movie releases make working at the theater a fun option. This is a great job any time of the year. There are several movie theaters located throughout. Age 13 and My year-old has autism and will need before-school (put on the bus) and after-school (pick up off the bus) care. I will also need someone. Jobs & Careers. Jobs & Careers · Find a Job · Career Development You will need working papers if you are under 18 years old. Working papers. job for 13 year old jobs in new york, ny · RN / LPN - Private Duty Nursing Homecare. Greater New York Nursing Services —Manhattan, NY. No supplemental O2 needed. My very own first job as a 12 year old was, yup, you guessed it, babysitting! It was for a kid who lived next door. And luckily for me, he was an easy kid to. Jobs for 13 Year Olds That Pay · Technology Guru Services · Pet Sitting and Walking · Babysitting in the Neighborhood · Mowing and Other Yard Work · Neighborhood.

Missouri's Child Labor Law applies to youth under age Youth under 14 years of age are not permitted to work at any job—other than in the agriculture or. Browse DETROIT, MI PART TIME 16 YEARS OLD jobs from companies (hiring now) with openings. Find job opportunities near you and apply! This page is for employers to post legitimate jobs for year olds and for teens who are seeking employment to connect. Summer jobs help you earn cash when you're off from school—and gain valuable experience that might lead to future work. · Make the most out of your summer. We have jobs for year-olds available. Sign up and upload your CV and start applying for jobs for year-olds today in the UK. There is a wide range of opportunities for you this summer and throughout the year! There are career exploration opportunities throughout the state. 13 year old jobs in Houston, TX · Assistant Two Year Old Teacher · Assistant Two Year Old Teacher · Caregivers Amazing Opportunities - Experienced Childcare. You get FREE admission to Worlds of Fun AND Oceans of Fun Waterpark; Year-round and seasonal job opportunities. View All Jobs. Upcoming Events. This page is for employers to post legitimate jobs for year olds and for teens who are seeking employment to connect. enjoyable experience at our establishment. You will be the first point Wages above this are outliers. $ - $ 13% of jobs. $ - $ 7 Cool Job for Year-Olds · 1. Babysitter A classic first job, babysitting is ideal for responsible teens. · 2. Lawn Mowing and Yard Work · 3. Pet Sitting and. Summer jobs help you earn cash when you're off from school—and gain valuable experience that might lead to future work. · Make the most out of your summer. PYN helps Teens connect with jobs and job training especially during summer months. 24 years old. Market St. Suite Call or Ewa Beach, HI • 13 miles away. Looking for sitter once a week day/night Part time sitter for two loving 3 year old Part time sitter for two. Fun park attendant: Amusement parks become more popular in the summer and they'll gladly hire teens to operate rides, sell tickets, or handle food stands. You. Two fun and silly girls, one 2 year old and one 7 year old! The older girl Family of 5 with a 17, 13 and almost 2 year old. Only the youngest would. Certain agricultural jobs. year-olds can hand-harvest berries, bulbs, cucumbers, and spinach during weeks that school is not in session. Harvest of any. Career, seasonal, part-time, student assistant and internship openings 13 paid sick leave days each year. Parental leave icon with family. Parental. Another fun option for teens who want to make money is to focus on platforms like TikTok and Snapchat. The age requirement to create an account on each platform.

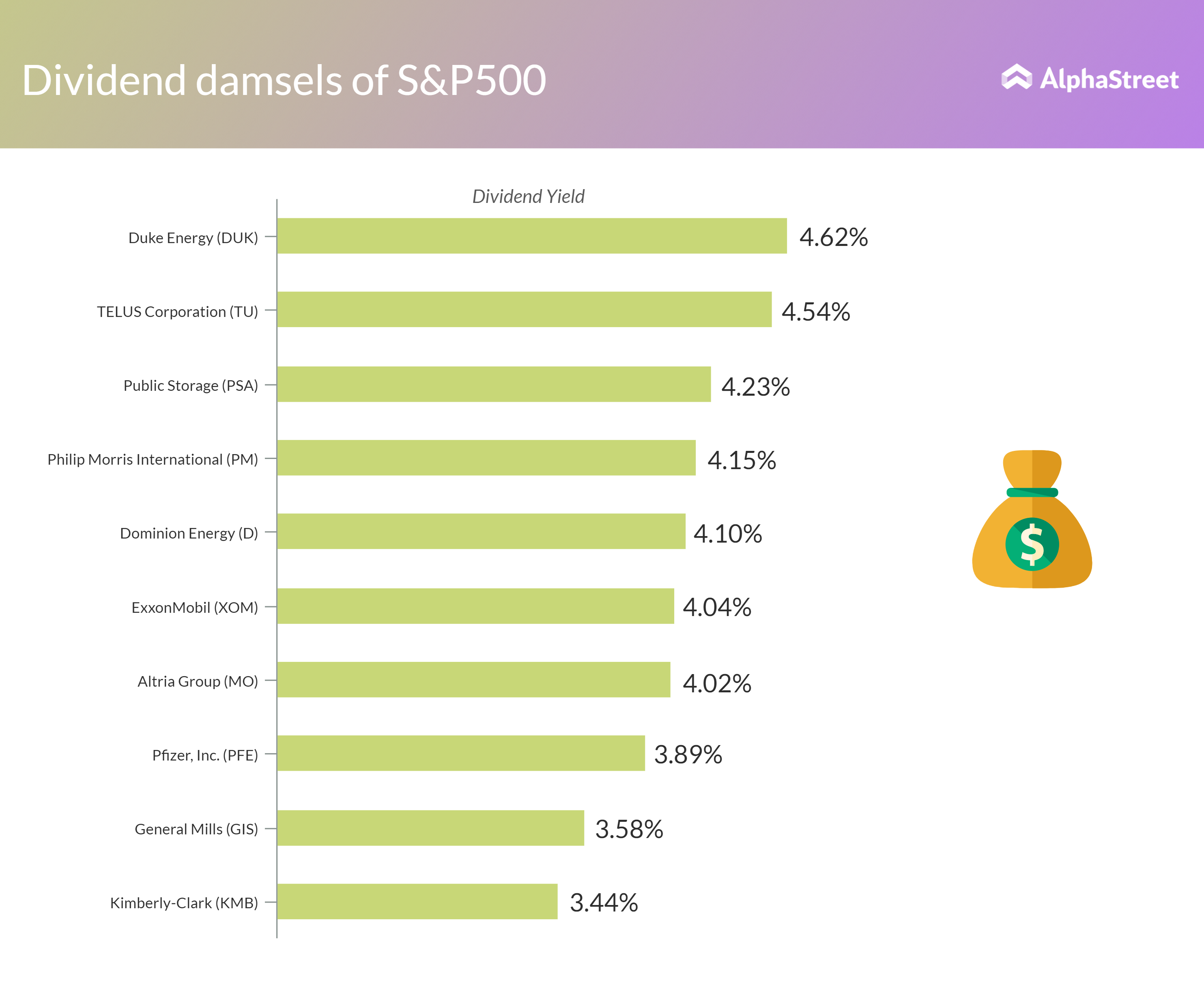

What Companies Pay Dividends In Stock

Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. See how they compare to other. Dividends are the distribution of earnings to shareholders, prorated by the class of security and paid in the form of money, stock, scrip, or, rarely, company. It's worth noting that investors close to retirement may not be able to experience the return potential of a dividend-paying stock over time. Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company will. The Coca-Cola Company Investors · Dividends. 53 Stocks ; PBT, Permian Basin Royalty Trust, % ; GLAD, Gladstone Capital Corporation, % ; LAND, Gladstone Land Corporation, % ; GAIN, Gladstone. 3 reasons to consider dividend investing. Earnings: Companies that pay dividends tend to show. 3 reasons to consider dividend investing. Buffers: Dividend. Apple (AAPL), Microsoft (MSFT), AT&T (T), and Exxon Mobil (XOM)1 are examples of companies that pay dividends. When companies opt not to pay dividends, it may. 9 best dividend stocks · 1. Lowe's · 2. Realty Income · 3. Chevron · 4. Target · 5. Starbucks · 6. Brookfield Infrastructure · 7. Microsoft. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. See how they compare to other. Dividends are the distribution of earnings to shareholders, prorated by the class of security and paid in the form of money, stock, scrip, or, rarely, company. It's worth noting that investors close to retirement may not be able to experience the return potential of a dividend-paying stock over time. Dividends are payments of income from companies in which you own stock. If you own stocks through mutual funds or ETFs (exchange-traded funds), the company will. The Coca-Cola Company Investors · Dividends. 53 Stocks ; PBT, Permian Basin Royalty Trust, % ; GLAD, Gladstone Capital Corporation, % ; LAND, Gladstone Land Corporation, % ; GAIN, Gladstone. 3 reasons to consider dividend investing. Earnings: Companies that pay dividends tend to show. 3 reasons to consider dividend investing. Buffers: Dividend. Apple (AAPL), Microsoft (MSFT), AT&T (T), and Exxon Mobil (XOM)1 are examples of companies that pay dividends. When companies opt not to pay dividends, it may. 9 best dividend stocks · 1. Lowe's · 2. Realty Income · 3. Chevron · 4. Target · 5. Starbucks · 6. Brookfield Infrastructure · 7. Microsoft.

The most comprehensive dividend stock destination on the web. Contains profiles, news, research, data, and ratings for thousands of dividend-paying stocks. Top High Dividend Stocks. © Macrotrends LLC | Terms of Service | Privacy Policy | Contact Us | LIMIT THE USE OF MY SENSITIVE PERSONAL. A stock dividend is a dividend paid in shares, generally issued to provide common shareholders with a portion of their respective interest in retained earnings. Dividend ETFs seek to provide high yields by investing in dividend-paying stocks. stocks that have a history of distributing dividends to their shareholders. Find dividend paying stocks and pay dates with the latest information from Nasdaq. Best Dividend Stocks ; AGNC Investment Corp. stock logo. AGNC. AGNC Investment. $ +%, 3, ; Walgreens Boots Alliance, Inc. stock logo. WBA. Walgreens. Dividend-paying stocks could potentially pump up total returns from your stock portfolio and generate extra income. World's companies with the highest dividend yields ; HAUTO · D · OSL, %, NOK ; RILY · D · NASDAQ, %, USD. Despite the recent drop in share prices, IBM still have strong dividend yields. IBM has been paying dividends to investors since and is currently on a Who pays dividends Companies that offer a dividend payout tend to be larger, more established companies with proven track records of reliable growth and stock. A stock dividend is a payment to shareholders in the form of additional shares in the company. · Stock dividends are not taxed until the shares are sold by their. US companies with the highest dividend yields ; TCPC · D · %, USD ; TRIN · D · %, USD ; OXSQ · D · %, USD ; PSEC · D · %, USD. Is all the talk about dividend-paying stocks just a fad? Or is there real merit to the dividend argument, particularly at this point in market history? Is all the talk about dividend-paying stocks just a fad? Or is there real merit to the dividend argument, particularly at this point in market history? Best dividend stocks · Comcast Corp. (CMCSA) · Bristol-Myers Squibb Co. (BMY) · Altria Group Inc. (MO) · Marathon Petroleum Corp. (MPC) · Diamondback Energy (FANG). Dividend-paying stocks provide a way for investors to get paid during rocky market periods, when capital gains are hard to achieve. They may provide some hedge. Payment of dividends are not mandatory; rather, the board of directors may use its discretion to decide whether to invest the company's profits back into the. A dividend is an amount of money paid regularly by a company to its shareholders. Dividend stocks are popular among investors because they are typically. A stock dividend is a regular payment you receive simply for owning shares of a certain company. In a way, it's like earning cash for doing almost nothing, but.

Homeowners Insurance Doberman

Best dog-friendly home insurance companies · American Family · Liberty Mutual · Nationwide · Amica · State Farm · Chubb · USAA · FAIR Plans. Methodology. It is important to note, however, not all dog breeds raise home insurance rates. In fact, insurance companies have conducted studies and determined that certain. The only way to know for sure how your pet will affect coverage is to talk with your insurer. Be honest with your insurance provider when discussing your pet. Your beloved dog's breed does not have to stop you from being properly insured. Independent agents can shop the insurance market for you in order to find you a. Your Dog's Breed and Behavior May Affect Your Homeowner's Insurance Coverage. Having a dog in the home is a risk factor for most insurance companies. Insurance. Probably. As noted above, your home insurance includes some level of personal liability coverage. And dog bites do fall under the category of a personal. The home insurers' “banned breeds” lists are long and include dogs you'd expect, like Rottweilers, some you might not expect, like German. Some home insurance carriers consider certain dog breeds to be more of a risk to insure. The breeds that most often increase your rates include Akita, Chow. Do I have to add my dog to my homeowners insurance policy? If you're asked about household pets on a home insurance application, you should always be truthful. Best dog-friendly home insurance companies · American Family · Liberty Mutual · Nationwide · Amica · State Farm · Chubb · USAA · FAIR Plans. Methodology. It is important to note, however, not all dog breeds raise home insurance rates. In fact, insurance companies have conducted studies and determined that certain. The only way to know for sure how your pet will affect coverage is to talk with your insurer. Be honest with your insurance provider when discussing your pet. Your beloved dog's breed does not have to stop you from being properly insured. Independent agents can shop the insurance market for you in order to find you a. Your Dog's Breed and Behavior May Affect Your Homeowner's Insurance Coverage. Having a dog in the home is a risk factor for most insurance companies. Insurance. Probably. As noted above, your home insurance includes some level of personal liability coverage. And dog bites do fall under the category of a personal. The home insurers' “banned breeds” lists are long and include dogs you'd expect, like Rottweilers, some you might not expect, like German. Some home insurance carriers consider certain dog breeds to be more of a risk to insure. The breeds that most often increase your rates include Akita, Chow. Do I have to add my dog to my homeowners insurance policy? If you're asked about household pets on a home insurance application, you should always be truthful.

A.R.S. § Homeowner's or renter's insurance; dog breeds; prohibitions; definitions. A. The breed of a dog may not be the sole factor considered or. If you have a furry friend, chances are you've had to think twice before getting homeowners insurance. Depending on the breed of your dog, some insurance. A standard home insurance policy does not provide coverage for damage to your personal property or to your home itself caused by your pet. Pet ownership comes. The breeds insurance companies believe pose the greatest risk of incident are labeled as "dangerous." The dangerous dog category includes pit bulls, rottweilers. Insurance companies that may insure otherwise black-listed dog breeds include Liberty Mutual, Nationwide, Amica, State Farm, Chubb, USAA (for military members. We love dogs and we have homeowners insurance carriers that have NO breed restrictions for dog liability insurance for the state of Ohio. While your MAPFRE homeowner's insurance liability coverage has certain benefits, you might want to consider adding Umbrella Insurance to your existing. When a dog attack victim receives an award of damages in a lawsuit, the dog owner will often cover the cost with his or her homeowner's insurance. However. If you have homeowners insurance and own a pet, the liability portion of your policy protects losses arising from pet ownership. Not only are you and your. “The presence alone of a dog in the home will not result in policy denial or exclusion of liability coverage,” he adds. However, “some dog breeds will require. Best dog-friendly home insurance companies · American Family · Liberty Mutual · Nationwide · Amica · State Farm · Chubb · USAA · FAIR Plans. Methodology. Insurance Requirements. As a dog owner, you are not legally required to carry coverage on your dog, but to protect yourself financially, you should ensure that. For homeowners and renters, this is not a good thing. The insurance company may deny you from getting homeowners' or renters' insurance because of your dog. Side note: we here at Lemonade HQ don't discriminate against these types of breeds intentionally, but based on national insurance data, we find we must exclude. If you have a furry friend, chances are you've had to think twice before getting homeowners insurance. Depending on the breed of your dog, some insurance. 14 dog breeds most homeowners insurance won't cover · 1. Wolf hybrids · 2. Alaskan malamutes · 3. Great Danes · 4. Cane Corsos · 5. Mastiffs · 6. Akitas · 7. Does home insurance cover dog bites? Personal liability coverage and medical payments coverage on your homeowners insurance policy may pay for injuries, legal. State Farm does not ask what breed of dog is owned when writing Homeowners or renters insurance. Just like humans, dogs are individuals. Every dog has a unique. Homeowners insurance can cover dog bites. However, not all homeowner's insurance policies cover them. Each company has its own way of handling dogs. Many of.

Can You Borrow From Ira Without Penalty

If you don't meet the qualifications, you may have to pay a 10% early withdrawal penalty for removing funds from your individual retirement account. One of the. If you are at least years old, you're at “retirement age” and can take money out of your (k) without the 10% fee that applies to early withdrawals. The. There is no IRS rule for an IRA loan, but you can take out funds that you have deposited with no penalty or taxation. And you can do a rollover from your Roth. You can withdraw funds from your IRA without penalty to pay qualified higher education expenses. You can also borrow from your (k). However, since the distribution is due to separation from employment (instead of default), you can roll over the amount of the loan balance to an IRA to avoid. This doesn't mean you cannot withdraw funds from your IRA account before reaching the specified age. Instead, the IRS guidelines permit early withdrawals in. While IRA plans don't allow loans, there are ways to get money out of your traditional or Roth IRA account in the short term without paying a penalty. You can receive distributions from your traditional IRA before age 59 1/2 without paying the 10% early withdrawal penalty. To do so, one of these exceptions. These plans use IRAs to hold participants' retirement savings. You can withdraw money from your IRA at any time. However, a 10% additional tax generally applies. If you don't meet the qualifications, you may have to pay a 10% early withdrawal penalty for removing funds from your individual retirement account. One of the. If you are at least years old, you're at “retirement age” and can take money out of your (k) without the 10% fee that applies to early withdrawals. The. There is no IRS rule for an IRA loan, but you can take out funds that you have deposited with no penalty or taxation. And you can do a rollover from your Roth. You can withdraw funds from your IRA without penalty to pay qualified higher education expenses. You can also borrow from your (k). However, since the distribution is due to separation from employment (instead of default), you can roll over the amount of the loan balance to an IRA to avoid. This doesn't mean you cannot withdraw funds from your IRA account before reaching the specified age. Instead, the IRS guidelines permit early withdrawals in. While IRA plans don't allow loans, there are ways to get money out of your traditional or Roth IRA account in the short term without paying a penalty. You can receive distributions from your traditional IRA before age 59 1/2 without paying the 10% early withdrawal penalty. To do so, one of these exceptions. These plans use IRAs to hold participants' retirement savings. You can withdraw money from your IRA at any time. However, a 10% additional tax generally applies.

You can “borrow” any amount from a Traditional or Roth IRA for under 60 days without penalty by making an indirect “rollover”. Basically, you. If you withdraw from a traditional IRA or (k) before this age, those withdrawals are subject to a 10% early withdrawal penalty and taxation at ordinary. However, taxes, and possibly a 10% penalty, can apply when you make an early withdrawal of investment earnings from a Roth IRA. To avoid these taxes and the. Be aware that there could be tax and penalty implications. If you take money out of your CalSavers Roth IRA and you don't meet the criteria for a qualified. If you're disabled, you can withdraw IRA funds without penalty. If you pass away, there are no withdrawal penalties for your beneficiaries. Medical expenses. You can't borrow from an IRA. You can withdraw, and roll the money back within 60 days (and IRS does count), but only once within a one-year. No, you cannot borrow against a Traditional or Roth IRA. Self-directed IRAs do not allow self-loans or loans to disqualified persons. You may withdraw funds. (k) withdrawals- If your employer's (k) plan allows for withdrawals for education expenses, you can withdraw from your (k) and avoid the IRS' 10% early. You can withdraw funds from your IRA without penalty to pay qualified higher education expenses. You can also borrow from your (k). Penalty-free. IRAs (including SEP-IRAs) do not permit loans. If this transaction was attempted, the IRA could be disqualified. Return to List of FAQs. 3. What happens if a. You can withdraw up to $10, from your IRA, without penalty, to buy, build, or rebuild a home — provided that you are a first-time home buyer. Higher. When you take a withdrawal from a SIMPLE IRA before age 59½, the IRS considers your withdrawal an early distribution. In many cases, you'll have to pay. If you're at least age 59½ and your Roth IRA has been open for at least five years, you can withdraw money tax- and penalty-free. See Roth IRA withdrawal rules. You will likely have to pay a 10% federal penalty for a premature distribution as well as a possible state penalty because you are under age /2. You may be. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. There would be no taxes imposed on funds that you borrow and pay back via a loan (unless you fail to pay it back, as noted below). What an early withdrawal from. You may be subject to federal and state income taxes, as well as an additional 10% federal income tax if you are under age 59½, unless an exception applies. You can withdraw up to $10, ($20, for couples) from an IRA to buy or build a first home without incurring the early withdrawal penalty. To qualify for the. If you are under 59½ and don't qualify for any of the exceptions to the early withdrawal rules (see "Can I withdraw money from my IRA early without penalty?").

How To Lose 30 Pounds In 3 Weeks

While I didn't get to 10% body fat, I did lose 22 pounds in three weeks, and then another few pounds in the last week. Over six weeks, I lost a total of I am by no means considered a expert or dietician/nutritionist. 30 pounds in 2 months is not healthy. You'd have to lose 4 pounds a week and the recommended. Not at OP's starting weight! % of your body weight per week is optimal. For OP, up to 8lbs a week would be very sustainable weight loss in. 3. Eating mindfully · Sitting down to eat, preferably at a table: Pay attention to the food and enjoy the experience. · Avoiding distractions while eating: Do not. Forget about “quick weight loss” promises. Plan on shedding about a pound or two a week. Slow and steady weight reduction is the healthiest approach. Take a. So right before I got married, I vowed to lose weight. By following the plan Keith made for me, I lost 33 pounds and whittled 5 inches off my waist in 12 weeks—. Losing 30 pounds requires a commitment to diet, exercise and improvements to your lifestyle. It's a fairly large weight loss goal and will require you to. in nine weeks, you need to lose between 3 and 4 lbs. per week. Following a low-fat diet plan will help you eat fewer calories. Engaging in a regular exercise. To reduce weight, you should brisk walk at least 30 minutes every day for six days a week. Work out four days a week: Work out with weights and bands four. While I didn't get to 10% body fat, I did lose 22 pounds in three weeks, and then another few pounds in the last week. Over six weeks, I lost a total of I am by no means considered a expert or dietician/nutritionist. 30 pounds in 2 months is not healthy. You'd have to lose 4 pounds a week and the recommended. Not at OP's starting weight! % of your body weight per week is optimal. For OP, up to 8lbs a week would be very sustainable weight loss in. 3. Eating mindfully · Sitting down to eat, preferably at a table: Pay attention to the food and enjoy the experience. · Avoiding distractions while eating: Do not. Forget about “quick weight loss” promises. Plan on shedding about a pound or two a week. Slow and steady weight reduction is the healthiest approach. Take a. So right before I got married, I vowed to lose weight. By following the plan Keith made for me, I lost 33 pounds and whittled 5 inches off my waist in 12 weeks—. Losing 30 pounds requires a commitment to diet, exercise and improvements to your lifestyle. It's a fairly large weight loss goal and will require you to. in nine weeks, you need to lose between 3 and 4 lbs. per week. Following a low-fat diet plan will help you eat fewer calories. Engaging in a regular exercise. To reduce weight, you should brisk walk at least 30 minutes every day for six days a week. Work out four days a week: Work out with weights and bands four.

So to lose one pound of fat per week, you need to cut calories per day from what you eat. Take your current weight and multiply it by That's a rough. You can lose 30 pounds in a healthy way. Start with a manageable weight loss goal, decrease your calorie intake, establish healthy eating habits, and engage in. Wishing you were 30 pounds lighter in time for your high school reunion Aim to lose 1 to 2 pounds a week, as this cadence is easiest to maintain, Dr. Weight Lifting and cardio will ramp up your metabolism, burn more calories and build the body up while doing so. Losing lbs a week is the way it should be. HOW I LOST 30 POUNDS IN 3 WEEKS! | CAMBRIDGE DIET · Comments thumbnail-image. In this situation my client lost 23 Lbs in 3 weeks, then 30 Lbs in 8 weeks, but then hit a plateau due to work and stress. With. If you're following a relatively aggressive weight loss plan and losing 2 pounds per week, a pound loss will take 15 weeks, or around 3 1/2 months. If you. But what about if you could enjoy the sunshine a good few pounds lighter? Diet Tips. Dietitian's Top 30 Diet Tips to Help You Lose Weight · Dieting Myths. Idea 3. I made sure I ate breakfast, which I usually skipped. By eating breakfast, it revs up your metabolism for the day, burning lots of calories from. How I lost 56 pounds of FAT and 10 inches off my waist - A full week of working out · HOW I LOST MY (INNER) THIGH FAT FAST - Chloe Ting Vs Lilly. 1. Set a Realistic Goal · 2. Add Protein to Your Diet · 3. Calculate Your Caloric Needs · 4. Design a Balanced & Nutritious Meal Plan · 5. Stay Hydrated · 6. Principle #2 - Invest In A High Tech Scale · Principle #3 - Spread Your Daily Calories Over 5 Meals Per Day · Principle #4 – Include a Cheat Meal Once a Week. Well, guys yes I did lose 30 pounds in 3 weeks. crazy right but nothing in life is impossible we just need to work on it. my journey was a. Well, guys yes I did lose 30 pounds in 3 weeks. crazy right but nothing in life is impossible we just need to work on it. my journey was a. lose 20–30 pounds for “weigh-ins. I couldn't jump as high, lift as much weight, or run as fast or as long as I had just a week before during. Guidelines suggest that you spread out this exercise during the course of a week. For even greater health benefit and to assist with weight loss or maintaining. While 30 pounds may seem like a lot, extending your weight loss goal for three months works out to about pounds per week. It seems like a more achievable. UPDATED VIDEO: WEIGHT LOSS JOURNEY: HOW I LOST 30 LBS IN 3 WEEKS STEP-BY-STEP | MOTIVATIONAL PURPOSES martemyanova.ru Hi. 1. Count calories · 2. Drink more water · 3. Increase your protein intake · 4. Reduce your refined carb consumption · 5. Start lifting weights · 6. Eat more fiber · 7.

Is The 5 Hour Energy Drink Safe

Consumers can spot caffeinated energy drinks and mixes that do not meet Canada's food safety standards by checking: High levels of caffeine may have adverse. 5-Hour Energy: "Feel it in minutes. Lasts for hours." The 2-ounce energy "shot" might also be dangerous, according to the Food and Drug Administration (FDA). Increased Risk of Heart Disease: Energy drinks contain high levels of synthetic caffeine, which can cause an increase in blood pressure and heart rate. Shop 5 Hour ENERGY at Walgreens. Find 5 Hour ENERGY coupons and weekly deals. Pickup & Same Day Delivery available on most store items. Consumers can spot caffeinated energy drinks and mixes that do not meet Canada's food safety standards by checking: High levels of caffeine may have adverse. Many of these ingredients, normally found in Monster Energy, Red Bull and 5-Hour Energy, have not been approved by the FDA as safe to consume. To give a. We recommend no more than two 5-hour ENERGY® products in one day, spaced several hours apart. Limit caffeine consumption to avoid nervousness, sleeplessness and. Conclusion: These data indicate that in a controlled laboratory environment, subjective feelings and cognitive performance are not impacted by caffeine or Isn't that dangerous? No. The levels of B and B-6 in each 5-hour ENERGY® shot are within safe limits. Are 5-hour ENERGY® shots kosher? Yes. 5-hour ENERGY®. Consumers can spot caffeinated energy drinks and mixes that do not meet Canada's food safety standards by checking: High levels of caffeine may have adverse. 5-Hour Energy: "Feel it in minutes. Lasts for hours." The 2-ounce energy "shot" might also be dangerous, according to the Food and Drug Administration (FDA). Increased Risk of Heart Disease: Energy drinks contain high levels of synthetic caffeine, which can cause an increase in blood pressure and heart rate. Shop 5 Hour ENERGY at Walgreens. Find 5 Hour ENERGY coupons and weekly deals. Pickup & Same Day Delivery available on most store items. Consumers can spot caffeinated energy drinks and mixes that do not meet Canada's food safety standards by checking: High levels of caffeine may have adverse. Many of these ingredients, normally found in Monster Energy, Red Bull and 5-Hour Energy, have not been approved by the FDA as safe to consume. To give a. We recommend no more than two 5-hour ENERGY® products in one day, spaced several hours apart. Limit caffeine consumption to avoid nervousness, sleeplessness and. Conclusion: These data indicate that in a controlled laboratory environment, subjective feelings and cognitive performance are not impacted by caffeine or Isn't that dangerous? No. The levels of B and B-6 in each 5-hour ENERGY® shot are within safe limits. Are 5-hour ENERGY® shots kosher? Yes. 5-hour ENERGY®.

Even in healthy people, a spike in blood pressure can be harmful. Energy drinks have been linked to heart attacks and — in rare cases — cardiac arrest. Labels. 5 Hour Energy™, Monster Energy™, Monster Energy Zero™, Java Monster Not enough data to deem the amount used in energy drinks as safe (22). Guarana. The full health effects of 5-Hour Energy are unknown because well-controlled clinical studies were not performed before the product was sold in the United. No. The levels of B and B-6 in each 5-hour ENERGY® shot are within safe limits. Are 5-hour ENERGY® shots kosher? Yes. The levels of B and B-6 in each 5-hour ENERGY® shot are within safe limits. The drink contains the same Energy Blend as found in Extra Strength 5-hour. The American Academy of Pediatrics Committee on Nutrition and the Council on Sports Medicine and Fitness state that energy drinks “are not appropriate for. How much caffeine is in my Monster or other energy drink? ; A Shoc, 16 oz. ; Bang, 16 oz. ; 5-hour Energy Extra Strength, oz. ; Starbucks Tripleshot. The little can promises a boost of energy when you need it, but what's really in it? KMBC 9's Dion Lim takes a look. No. The levels of B and B-6 in each 5-hour ENERGY® shot are within safe limits. Are 5-hour ENERGY® shots kosher? Yes. This drink is much safer and more natural than others. Contains NO extra sugar or fructose. Use this for those crammed days with good judgement --also -. energy and alertness. Is it safe for teenagers to drink energy drinks? While there are no age restrictions on energy drinks, the Centers for Disease Control. Drink one half (1/2) bottle for moderate energy. Drink one whole bottle for maximum energy. Do not exceed two bottles of 5-hour ENERGY shots daily, consumed. Quick, simple and effective. Provides a feeling of alertness and energy. · Zero sugar and packed with B vitamins and amino acids. · Regular Strength 5-hour ENERGY. Some energy drinks, such as 5-Hour Energy, combine large doses of caffeine with sugar and amino-acids — a combination that could lead to medical complications. Are energy drinks safe for my child or teen? Energy drinks are not recommended for children and teens because of the amount of caffeine, sugars and other. While many people drink energy drinks to help them get through a long day or to keep them alert and focused, drinking too many at once may exacerbate. serving and Extreme energy 5-Hour Shot contains mg per 2 fl. oz. serving Are Energy Drinks Safe? Caffeine is a central nervous system stimulant. A growing number of studies are finding that products like Monster, Red Bull, and 5-Hour Energy offer a variety of health dangers with no unique benefits. Shop top deals and earns rewards on 5 Hour Energy products at Rite Aid. Buy online and pick up in-store today. hours for your body to reduce the content Meaning you'll get used to to it and so won't feel the effects as much. POISON. He p. SO IS IT GOOD OR BAD TO.

Is Wec A Good Stock To Buy

The Score for WEC is 51, which is 2% above its historic median score of 50, and infers lower risk than normal. WEC is currently trading in the % percentile. WEC Energy Group (NYSE:WEC) Stock, Analyst Ratings, Price Targets, Forecasts ; $ based on the ratings of ; 17 analysts. The high is ; $ issued by ; Wolfe. In the current month, WEC has received 9 Buy Ratings, 6 Hold Ratings, and 3 Sell Ratings. WEC average Analyst price target in the past 3 months is $ The average one-year price target for WEC Energy Group, Inc. is $ The forecasts range from a low of $ to a high of $ A stock's price. View analyst opinion as to whether the stock is a strong buy, strong sell or hold, based on analyst Month WEC price targets. Created with Highcharts WEC Energy Group Inc stock has a Growth Score of 55, Estimate Revisions Score of 53 and Quality Score of Comparing American Electric Power Company Inc and. The Ultimate Dividend Growth Stock to Buy With $ Right Now (and It Isn't NextEra Energy). Most dividend growth investors know how attractive NextEra Energy. View WEC Energy Group Inc WEC stock quote prices, financial information Strong Buy Rating with Raised Price Target Amid Growth and Stability by. WEC Energy Group has received a consensus rating of Hold. The company's average rating score is , and is based on 4 buy ratings, 5 hold ratings. The Score for WEC is 51, which is 2% above its historic median score of 50, and infers lower risk than normal. WEC is currently trading in the % percentile. WEC Energy Group (NYSE:WEC) Stock, Analyst Ratings, Price Targets, Forecasts ; $ based on the ratings of ; 17 analysts. The high is ; $ issued by ; Wolfe. In the current month, WEC has received 9 Buy Ratings, 6 Hold Ratings, and 3 Sell Ratings. WEC average Analyst price target in the past 3 months is $ The average one-year price target for WEC Energy Group, Inc. is $ The forecasts range from a low of $ to a high of $ A stock's price. View analyst opinion as to whether the stock is a strong buy, strong sell or hold, based on analyst Month WEC price targets. Created with Highcharts WEC Energy Group Inc stock has a Growth Score of 55, Estimate Revisions Score of 53 and Quality Score of Comparing American Electric Power Company Inc and. The Ultimate Dividend Growth Stock to Buy With $ Right Now (and It Isn't NextEra Energy). Most dividend growth investors know how attractive NextEra Energy. View WEC Energy Group Inc WEC stock quote prices, financial information Strong Buy Rating with Raised Price Target Amid Growth and Stability by. WEC Energy Group has received a consensus rating of Hold. The company's average rating score is , and is based on 4 buy ratings, 5 hold ratings.

After my purchase earlier this month, WEC is now my portfolio's largest utility holding. The company's growth outlook for the foreseeable future is encouraging. If you are looking for stocks with good return, WEC Energy Group Inc stock can be a bad, high-risk 1-year investment option. WEC Energy Group Inc real time. Based on 17 analysts giving stock ratings to WEC in the past 3 months. Neutral. SellBuy. Strong sellStrong buy. Strong sellSellNeutralBuyStrong buy. Strong buy. In the current month, 1WEC has received 6 Buy Ratings, 4 Hold Ratings, and 3 Sell Ratings. 1WEC average Analyst price target in the past 3 months is € The consensus among 6 Wall Street analysts covering (NYSE: WEC) stock is to Buy WEC stock. Out of 6 analysts, 2 (%) are recommending WEC as a Strong Buy, 1. WEC Energy Group Inc. analyst ratings, historical stock prices, earnings estimates & actuals. WEC updated stock price target summary Buy Side from WSJ. The intrinsic value of one WEC stock under the Base Case scenario is USD. Compared to the current market price of USD, WEC Energy Group Inc is. WEC Stock Overview · Trading at % below our estimate of its fair value · Earnings are forecast to grow % per year · Earnings have grown % per year over. The 13 analysts with month price forecasts for WEC Energy Group stock have an average target of , with a low estimate of 78 and a high estimate of So WEC Energy Group, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth. Should I Buy WEC Energy Group Inc Stock? Overall, WEC Energy Group Inc stock has a Value Grade of C, Momentum Grade of C Earnings Estimate Revisions Grade of C. Based on the WEC Energy Group stock forecast, it's now a bad time to buy WEC stock because it's trading % above our forecast, and it could be overvalued. Considering the day investment horizon and your above-average risk tolerance, our recommendation regarding WEC Energy Group is 'Strong Buy'. WEC Energy Group currently has an average brokerage recommendation (ABR) of on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the. In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market. Here's Why I Just Bought This High-Yield Dividend Stock I just added another utility to my portfolio. I was done in this sector until I saw this high-yield. It has underperformed other stocks in the Utilities - Regulated Electric industry by percentage points. Wec Energy Group stock is currently +% from its. The intrinsic value of one WEC stock under the Base Case scenario is USD. Compared to the current market price of USD, WEC Energy Group Inc is. stock outperforms competitors on strong trading day. Aug. 22, at 5 WEC: Which Stock Should Value Investors Buy Now? Aug. 21, at a.m. In that case, they are not buying WEC because the equity is a good investment, but because they need to do something to avoid the feeling of missing out. On the.

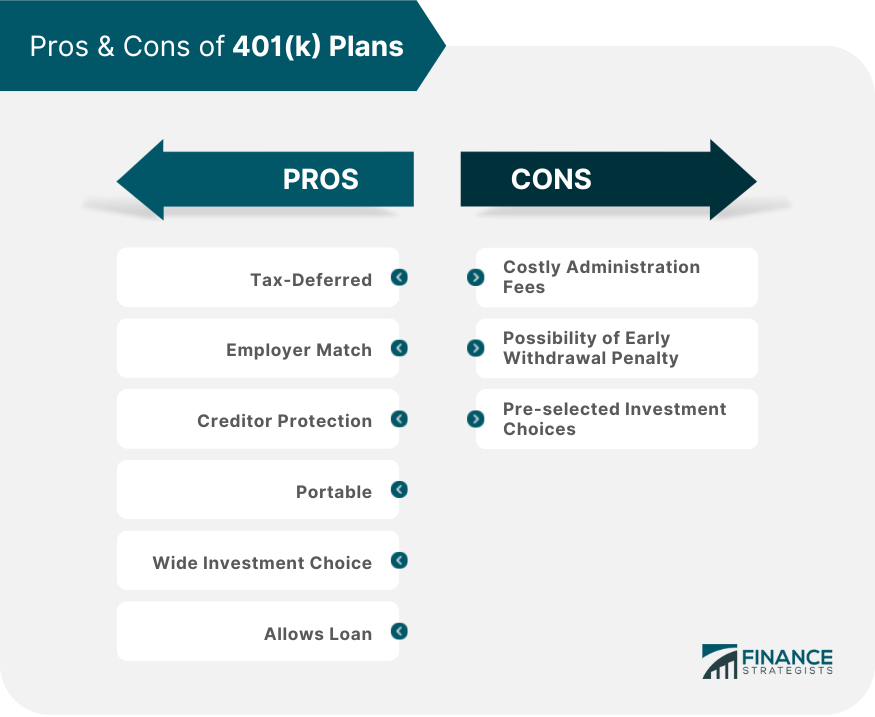

401k Matching Explained

The most common form of contribution is a match, meaning the business owner is only responsible for making a contribution when the employee does so. Often, this match is 50 cents or $1 for each dollar your employee contributes. There is also often a cap on the amount the employer will match, such as 6% of. Matching (k) contributions are the additional contributions made by employers, on top of the contributions made by employees. For example, let's assume your employer provides a 50% match on the first 6% of your annual salary that you contribute to your (k). If you have an annual. Key takeaways A (k) match is when an employer puts money in an employee's retirement account based on what the employee contributes. Max out your match Let's say you work for an employer who matches your (k) contributions dollar-for-dollar up to 6% of your $45, salary. If you save the. A (k) employer match is money your company contributes to your (k) account. If your employer offers (k) matching, it means they will match the. These contributions may be employer matching contributions, limited to employees who defer, or employer contributions made on behalf of all eligible employees. To make payroll deductions for retirement savings more appealing, employers sometimes offer to match the contributions their employees make. These matching. The most common form of contribution is a match, meaning the business owner is only responsible for making a contribution when the employee does so. Often, this match is 50 cents or $1 for each dollar your employee contributes. There is also often a cap on the amount the employer will match, such as 6% of. Matching (k) contributions are the additional contributions made by employers, on top of the contributions made by employees. For example, let's assume your employer provides a 50% match on the first 6% of your annual salary that you contribute to your (k). If you have an annual. Key takeaways A (k) match is when an employer puts money in an employee's retirement account based on what the employee contributes. Max out your match Let's say you work for an employer who matches your (k) contributions dollar-for-dollar up to 6% of your $45, salary. If you save the. A (k) employer match is money your company contributes to your (k) account. If your employer offers (k) matching, it means they will match the. These contributions may be employer matching contributions, limited to employees who defer, or employer contributions made on behalf of all eligible employees. To make payroll deductions for retirement savings more appealing, employers sometimes offer to match the contributions their employees make. These matching.

If your retirement plan offers matching, many companies will typically match 50% or % of your contributions up to a certain percentage of your salary. The most common (k) matching contribution is an employer contribution of 50 cents for each dollar an employee contributes, up to 6% of the employee's pay. Starbucks partners can contribute (k) pre-tax or Roth after-tax dollars, and Starbucks will match your eligible contributions. Playing in picture-in-picture. One of the most important aspects of a (k) is the matching contributions your employer can make to your account. It's basically a "free" contribution. If you put in at least 8% of your paycheck into the k, your employer will match this amount. So in your case if you put in 10% ($5,) this. When an employer matches your contributions, they add a certain amount to your (k) account in addition to what you contribute. One way employers determine. Contributions that you make to your own (k) are always % vested. (k) vesting schedules for matching contributions made by an employer may vary from. As an employer, you can take ownership of part or all of your employer match contributions through a practice known as vesting. The legal definition of. k matching means that your employer also contributes money into your k based on how much you contribute up to a maximum amount. · So 7% matching means your. Depends on their k plan. Every company has their own k plan, with their own rules and matches. The k match can be anything from. Many retirement plans, such as SIMPLE IRAs and (k)s, provide that your employer will match some portion of the amount you contribute to your retirement. If your employer offers partial matching, it will match part of the money you put in to a (k) account, up to a specific limit. Most employers provide a 50%. These contributions may be employer matching contributions, limited to employees who defer, or employer contributions made on behalf of all eligible employees. The average employer (k) match is at an all-time high at %. This means that, on average, companies will match % of an employee's salary toward their. In most companies, employers offer a match of up to 6% of the employee's income and up to 50% of their Roth (k) contribution. For example, if you earn an. A true-up is an additional, end-of-year matching contribution made by an employer to an employee's (k) account. Learn why it happens. Often, this match is 50 cents or $1 for each dollar your employee contributes. There is also often a cap on the amount the employer will match, such as 6% of. k Matching Explained. If you contribute to your k, your employer may match your contribution. The most common match is % up to some percentage of. Lots of defined contribution plans come with a bonus: a matching contribution from your company. The match can often be 50 cents to a dollar for every. Maximizing (k) Company Match and Unintended Pitfalls · The individual is not contributing to the K plan, or not contributing enough to maximize the match.

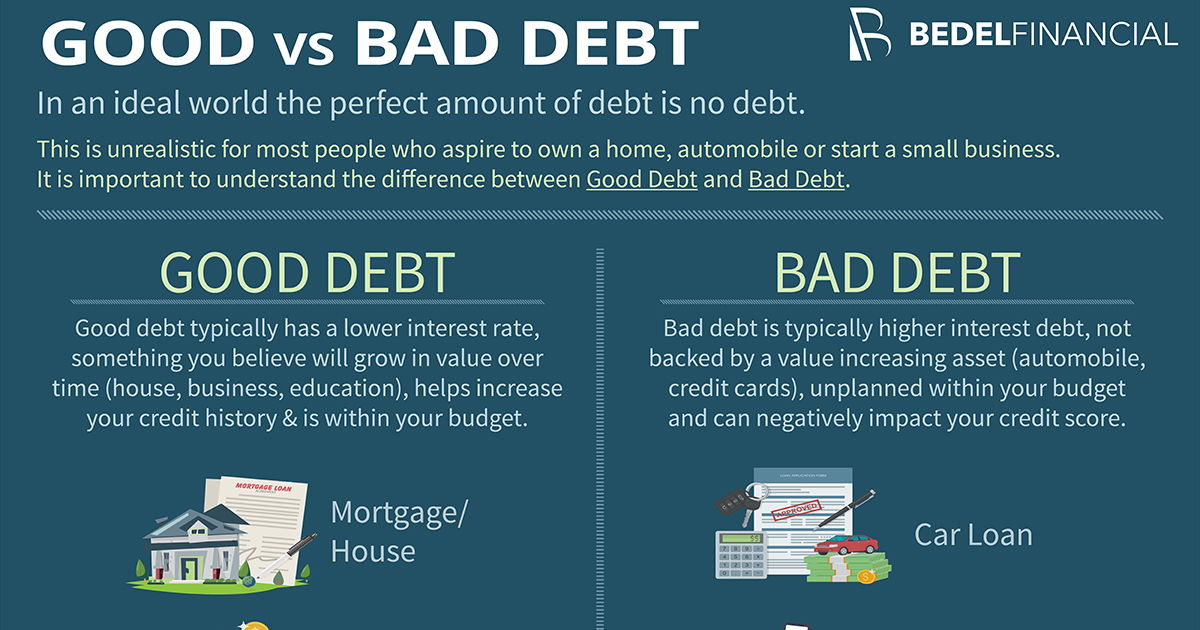

Good And Bad Debt

Good debt is really anything that is spent on items that can appreciate or increase in value (like mortgages on homes and education loans). But. Good debt vs. bad debt. Not all of the balances you carry will drag down your financial future. Despite the bad rap debt often gets – and it's mostly deserved —. Good debt like a mortgage or student loans can help you achieve goals. Bad debt can derail goals with costly interest rates. What separates good and bad debt? Good debt can help you achieve long-term financial goals while bad debt serves an immediate need that does not increase in. So, what is “good debt"? Speaking generally, debt that you're able to repay responsibly based on the loan agreement can be "good debt," as a favorable payment. Key tips on understanding good debt vs. bad debt · Products or services paid to generate income beyond the debt or loan value (e.g. business loans) · Debts that. Debts are usually put in one category or another: good or bad. It's smart for borrowers to weigh their good debt vs. bad debt. While good debt is considered an investment that will grow in value or generate long-term income, bad debt is just the opposite, a debt that is accrued to. Too much debt can turn good debt into bad debt. You can borrow too much for important goals like college, a home, or a car. Too much debt, even if it is at. Good debt is really anything that is spent on items that can appreciate or increase in value (like mortgages on homes and education loans). But. Good debt vs. bad debt. Not all of the balances you carry will drag down your financial future. Despite the bad rap debt often gets – and it's mostly deserved —. Good debt like a mortgage or student loans can help you achieve goals. Bad debt can derail goals with costly interest rates. What separates good and bad debt? Good debt can help you achieve long-term financial goals while bad debt serves an immediate need that does not increase in. So, what is “good debt"? Speaking generally, debt that you're able to repay responsibly based on the loan agreement can be "good debt," as a favorable payment. Key tips on understanding good debt vs. bad debt · Products or services paid to generate income beyond the debt or loan value (e.g. business loans) · Debts that. Debts are usually put in one category or another: good or bad. It's smart for borrowers to weigh their good debt vs. bad debt. While good debt is considered an investment that will grow in value or generate long-term income, bad debt is just the opposite, a debt that is accrued to. Too much debt can turn good debt into bad debt. You can borrow too much for important goals like college, a home, or a car. Too much debt, even if it is at.

"Good" Debt vs. "Bad" Debt: What Is the Difference? · "Good" debt is debt that has the potential to increase your net worth or improve and enhance your life in a. If you buy something that immediately goes down in value, that's bad debt. Let's say you buy disposable items or durable goods with a high-interest credit card. On the other hand, bad debt is typically higher interest debt, not backed by a value increasing asset (automobile, credit cards), unplanned within your budget. Good vs. Bad Debt · How you can break the house-rich, cash-poor cycle · Which debts are good, which are bad, and how you can pay down your bad debt while. Good debt is money borrowed to help build important things in your life. It helps steer you toward your goals. Bad debt does the opposite. Good debt has the potential to increase your wealth, while bad debt costs you money with high interest on purchases for depreciating assets. Determining whether. What is Bad Debt? Bad debt is defined as when you take out money or credit to purchase items you want, rather than need. Over time, these purchases will. I categorize all debt as “bad debt.” I have no debt of any kind. My debt avoidance strategy over the past 30 years or so has been to purchase nothing I didn't. Debt falls into two main categories – good or bad. Here are some differences between them. Think of good debt as something long-term that. 'Bad' debt isn't necessarily bad, but this term usually refers to credit used either for fast consumption or for spending that provides only a brief benefit. Debt can be good or bad—and part of that depends on how it's used. · Generally, debt used to help build wealth or improve a person's financial situation is. Credit Card Debt Owing money to your credit card is one of the most common types of bad debt. Credit cards are issued by lenders and allow you to make. Bad debt generally includes borrowing to pay for routine living expenses. It's a poor debt management strategy because with the added interest cost, you're. Good debt can help you build wealth as its value can grow. · Bad debt can leave you worse off in the long run with purchases quickly depreciating in value. · In. When you defer payment and obtain credit, you end up with a debt. "Good debt" is one that can make you better off financially in the long run. "Bad debt". Bad debt owed to your business is debt that technically cannot be recovered, such as your customer becoming insolvent. Writing off bad debt from a customer can. Examples of “good debt” include home mortgages, auto loans, and some student debt. Examples of “bad debt” include Payday loans, credit cards debt, and borrowing. When you defer payment and obtain credit, you end up with a debt. "Good debt" is one that can make you better off financially in the long run. "Bad debt". When we talk about “good debt”, it usually refers to debt that was taken on to help advance your future income or increase your net worth. Bad debt, on the. Very few people have enough money to pay cash for life's most important purchases, which is where debt helps. Here's the difference between good & bad debt.

Best Way To Invest 50000 For 5 Years

Input a starting year and an end year. Enter an annual interest rate and an annual rate of inflation. Click Calculate. (Start by entering “1”, then you can increase this to see how much you can earn over more years.) Estimated rate of return: 5%. Compound frequency. Series I Savings Bonds to keep up with inflation. Or 1-year CDs. Or a Federal Money Market. Nothing that could lose principle if you actually. Flexible Investment: Invest lumpsum or start a Systematic Investment Plan (SIP). Best Short-Term Investment Options for 3 Months. The best short-term investment. Use our investment calculator to calculate the return for your investments. Adjust your amount, rate of return and years invested to calculate additional. Unit Linked Insurance Plan (ULIP), 5 years, Wealth + Life cover ; Initial Public Offerings (IPO), As per the investment profile, Long-term outlook with risk-. 10 ways to invest $50, · 1. Invest with a robo-advisor · 2. Buy individual stocks · 3. Real estate · 4. Individual bonds · 5. Mutual funds · 6. ETFs · 7. CDs. After 10 years, your 50k would become $, Now we're talking! If you can work it a little harder and earn a little extra on your investments, the payoff. Alternatives to investing money · Fixed rate bonds are ideal for anyone who has a lump sum that they can afford to lock away for a set period of time without. Input a starting year and an end year. Enter an annual interest rate and an annual rate of inflation. Click Calculate. (Start by entering “1”, then you can increase this to see how much you can earn over more years.) Estimated rate of return: 5%. Compound frequency. Series I Savings Bonds to keep up with inflation. Or 1-year CDs. Or a Federal Money Market. Nothing that could lose principle if you actually. Flexible Investment: Invest lumpsum or start a Systematic Investment Plan (SIP). Best Short-Term Investment Options for 3 Months. The best short-term investment. Use our investment calculator to calculate the return for your investments. Adjust your amount, rate of return and years invested to calculate additional. Unit Linked Insurance Plan (ULIP), 5 years, Wealth + Life cover ; Initial Public Offerings (IPO), As per the investment profile, Long-term outlook with risk-. 10 ways to invest $50, · 1. Invest with a robo-advisor · 2. Buy individual stocks · 3. Real estate · 4. Individual bonds · 5. Mutual funds · 6. ETFs · 7. CDs. After 10 years, your 50k would become $, Now we're talking! If you can work it a little harder and earn a little extra on your investments, the payoff. Alternatives to investing money · Fixed rate bonds are ideal for anyone who has a lump sum that they can afford to lock away for a set period of time without.

before you invest. If you decide to buy stock in a new or small company For example, let's assume that Maria's savings grow by 5% a year. If she. By diversifying your investments across large cap, mid cap, flexi cap, aggressive hybrid, and debt mutual funds, you can achieve good returns while ensuring. At least once a year, take a look at your investments and make sure you have the right amount of stocks, bonds, and cash to stay on track to meet your long-term. Investing should always be seen as a long-term strategy of 5 years or more. The longer you invest for, the longer your pot will have to recover from any market. I invest % in total-market, index-based, low-cost mutual funds. Specifically, I use mostly Vanguard's Total Stock Market, Total Bond Market. How to calculate compound interest. To calculate how much $2, will earn over two years at an interest rate of 5% per year, compounded monthly: 1. Divide the. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy. Suppose you invested Rs for 5 years at a compound interest of 10% per annum; interest is compounded annually. Here, at the end of tenure, you will get Rs. Here's the question you face: Should you invest it all right away or in smaller increments over time, a strategy known as dollar-cost averaging? Know that with an income of $50,, the constraints of living expenses may at first keep you from investing as much as you would like. The key, though, is to. Alternatives to investing money · Fixed rate bonds are ideal for anyone who has a lump sum that they can afford to lock away for a set period of time without. A plan is a state-sponsored college investment plan. The major benefit of investing $50, in a plan is that it allows your money to grow tax-free as. Determine how much your money can grow using the power of compound interest. * DENOTES A REQUIRED FIELD. Calculator. Step 1: Initial Investment. Suppose you invested Rs for 5 years at a compound interest of 10% per annum; interest is compounded annually. Here, at the end of tenure, you will get Rs. Mutual funds will be the best option for you. Do not go for Insurance as investment option as you will hardly earn. 6 - 8% returns. FD gives you. Determine how much your money can grow using the power of compound interest. * DENOTES A REQUIRED FIELD. Calculator. Step 1: Initial Investment. How much interest you'd earn by investing $10, in a 1-year CD · How a $10, deposit could grow over time · How to decide between a CD and another savings. It depends on how long you want to invest this money. · You can invest In equity mutual funds which will give you 12 to 14 % returns per year. Property investment is likely the best way to invest 50k. · It would help if you spoke to a financial advisor before deciding to invest money. · A savings account.