martemyanova.ru

Gainers & Losers

Katy Huberty Morgan Stanley

Morgan Stanley analyst Katy Huberty maintained $Apple (martemyanova.ru)$ with an Overweight rating and raised the price target from $ to $ May 20, / PM GMTKathryn Lynn Huberty - Morgan Stanley, Research Division - MD and Research Analyst Good morning, everyone. I'm Katy Huberty. Katy L. Huberty is the Global Head of Research at Morgan Stanley. Katy joined Morgan Stanley in as a Research Associate on the enterprise hardware team. Top 5 projects with largest spend increase in Morgan Stanley CIO Survey (% Total Responses). Source: Morgan Stanley AlphaWise CIO Survey. Consider a few. Katy Huberty is Global Director of Research and a member of the Firm Management Committee · Experience: Morgan Stanley · Location: New York · +. /PRNewswire/ -- Dell Technologies (NYSE: DELL) announces a virtual fireside chat hosted by Katy Huberty from Morgan Stanley on Tuesday, June 23, at 9. Kathryn Huberty is a star Wall Street Analyst at Morgan Stanley. Kathryn Huberty's focuses on the Technology sector and covers 40 stocks with a %. Morgan Stanley's Katy Huberty sees Apple rallying 20% in the next 12 months based on her $ per share price target. Katy Huberty is focusing Morgan Stanley's research team on 3 themes it expects to drive markets in ' technology diffusion. Morgan Stanley analyst Katy Huberty maintained $Apple (martemyanova.ru)$ with an Overweight rating and raised the price target from $ to $ May 20, / PM GMTKathryn Lynn Huberty - Morgan Stanley, Research Division - MD and Research Analyst Good morning, everyone. I'm Katy Huberty. Katy L. Huberty is the Global Head of Research at Morgan Stanley. Katy joined Morgan Stanley in as a Research Associate on the enterprise hardware team. Top 5 projects with largest spend increase in Morgan Stanley CIO Survey (% Total Responses). Source: Morgan Stanley AlphaWise CIO Survey. Consider a few. Katy Huberty is Global Director of Research and a member of the Firm Management Committee · Experience: Morgan Stanley · Location: New York · +. /PRNewswire/ -- Dell Technologies (NYSE: DELL) announces a virtual fireside chat hosted by Katy Huberty from Morgan Stanley on Tuesday, June 23, at 9. Kathryn Huberty is a star Wall Street Analyst at Morgan Stanley. Kathryn Huberty's focuses on the Technology sector and covers 40 stocks with a %. Morgan Stanley's Katy Huberty sees Apple rallying 20% in the next 12 months based on her $ per share price target. Katy Huberty is focusing Morgan Stanley's research team on 3 themes it expects to drive markets in ' technology diffusion.

Morgan Stanley Katy Huberty. Related by string. * Mor gan. Morgans. MORGAN: Morgan Stanley MS.N Quote. Morgan Stanley Dean Witter. JP Morgan Chase / Stan. In a note to clients, Morgan Stanley analyst Katy Huberty suggests that the spread of coronavirus within China will give people more time to buy apps from the. An investment note by Morgan Stanley Katy Huberty predicts that Apple will see its iPhone sales fall by % in Apple's financial year, reports Business. Katy Huberty - The ROI of Tech in Lisa Shallet - Outsmarting Volatility Social Every 10 years, a new trend in computing creates significant value. Is the next one within sight? Katy Huberty explains. See more ideas about the next cycle of. Katy Huberty is a Managing Director in Research at financial services company Morgan Stanley. As a Research Analyst, she covers US tech industry stocks. Katy joined Morgan Stanley in as a Research Associate on the enterprise hardware team and currently covers the enterprise systems and PC hardware industry. Katy Huberty. After Netflix' Disappointment Spotlight Shifts to Apple, Amazon Morgan Stanley Raises Apple Price Target On iPhone Trade-In Opportunity. Katy Huberty is well known and I think a pretty good analyst. I forget the name of the tobacco analyst and not sure if he's there anymore. From "Apple, Qualcomm in focus as Morgan Stanley says smartphone recovery 'not yet priced in'" posted Tuesday by Seeking Alpha. Read More What Katy Huberty said. Katy Huberty is a Wall Street analyst working for Morgan Stanley. Katy has covered 15 stocks with a % success rate and an average return of %. Katy Huberty's Post. View profile for Katy Huberty Managing Director at Morgan Stanley | Head of Cross Asset & Special Situations Sales. Because of its near bezel-free design, the upcoming inch LCD iPhone might not launch until October, according to Morgan Stanley's Katy Huberty, a noted. Morgan Stanley's global director of research, Katy Huberty, said in an investor note. For investors that share a similar mindset with Morgan Stanley, they. Morgan Stanley's Katy Huberty believes that Apple's Services, critical to the company's share price, will continue to see sustained. Morgan Stanley analyst Katy Huberty says a slowdown in app store sales could hit Apple's Q3 revenues martemyanova.ru A new data-driven technology cycle is just starting and offers huge potential on the investing front, Morgan Stanley analysts including Katy Huberty wrote in a. Morgan Stanley (MS) names Katy Huberty research head - Bloomberg. July 25, AM. Morgan Stanley (NYSE (Premium-only article. Morgan Stanley analyst Katy Huberty on Tuesday raised her Apple price target to $ from $ AAPL shares rose over % to set a new '. In this episode, Honeywell CEO Darius Adamczyk sits down with Morgan Stanley's Katy Huberty to discuss Honeywell's marriage of industrial hardware and 21st.

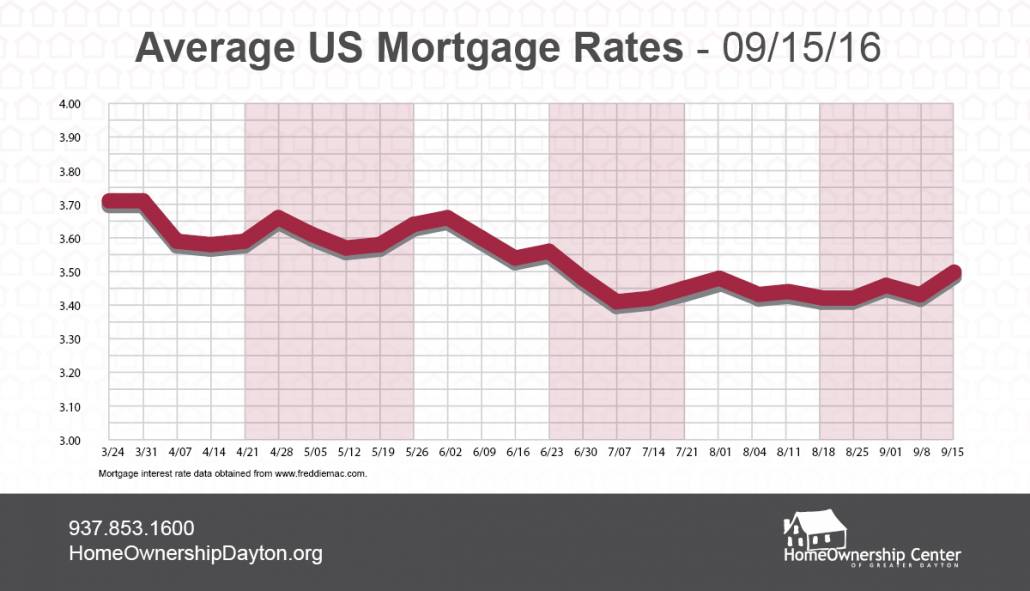

Good Apr Rate For Mortgage

As of August 27, , the best mortgage rates in Canada are: 5-year fixed at %, 3-year fixed at %, and 5-year variable at %. A great choice when you want a stable monthly mortgage payment. Interest rate as low as. %. APR as low as. %. Special offers on certain terms ; 5 year variable rate · % · %** APR) ; 4 year fixed rate · % · % · APR) ; 5 year fixed rate · % · %** APR). A good interest rate on a personal loan is generally one that's at or below the national average. Lenders will also consider your creditworthiness when. The Annual Percentage Rate (APR) is based on a $, mortgage, 25 year Getting a mortgage pre-approval is a great way to find out how much you may be able. The Annual Percentage Rate (APR) for the posted rates above open fixed-rate mortgages are: 6 month %, 1 year % and 2 years %. Closed variable-rate. Explore current RBC mortgage rates, including fixed rates, variable rates, and special offers. If you're shopping for a mortgage, the annual percentage rate (APR) is a good way to compare our mortgage rates against other mortgage lenders. Interest rate vs. Explore our mortgage solutions from closed or open mortgages with fixed or variable rate options to find the right mortgage rate for you. As of August 27, , the best mortgage rates in Canada are: 5-year fixed at %, 3-year fixed at %, and 5-year variable at %. A great choice when you want a stable monthly mortgage payment. Interest rate as low as. %. APR as low as. %. Special offers on certain terms ; 5 year variable rate · % · %** APR) ; 4 year fixed rate · % · % · APR) ; 5 year fixed rate · % · %** APR). A good interest rate on a personal loan is generally one that's at or below the national average. Lenders will also consider your creditworthiness when. The Annual Percentage Rate (APR) is based on a $, mortgage, 25 year Getting a mortgage pre-approval is a great way to find out how much you may be able. The Annual Percentage Rate (APR) for the posted rates above open fixed-rate mortgages are: 6 month %, 1 year % and 2 years %. Closed variable-rate. Explore current RBC mortgage rates, including fixed rates, variable rates, and special offers. If you're shopping for a mortgage, the annual percentage rate (APR) is a good way to compare our mortgage rates against other mortgage lenders. Interest rate vs. Explore our mortgage solutions from closed or open mortgages with fixed or variable rate options to find the right mortgage rate for you.

loan's annual percentage rate (APR). What's the difference? Interest APR as a good basis for comparing certain costs of loans. (Remember, though. Comparing the annual percentage rate (APR) and the interest rate on competing loans helps you understand the true cost of a loan. Rate % ; APR % ; Points ; Monthly Payment $1, Mortgage rates. Great rates are just the start. Talk to a Home Financing The above Annual Percentage Rates (APR) for our special offers are. 6 or.8%. This can be a good idea if you plan on being in the home long term and you have excess cash you can bring to closing. Get the best mortgage rate by comparing quotes from 50+ providers in Ontario. Getting quotes is just a click away with RATESDOTCA. Get your quote now! A great resource for comparing both APR and APY rates on a mortgage is a mortgage calculator. average interest rate is on a typical personal loan. more. The average rate on a year mortgage rose to % this week, according to Bankrate's lender survey. Thirty-year rates haven't been this low since May Unlike an interest rate, however, it includes other charges or fees such as mortgage insurance, most closing costs, discount points and loan origination fees. For example, if you were considering a mortgage loan for $, with a 6% interest rate, your annual interest expense would amount to $12,, or $1, a. Let's say two lenders offer you fixed-rate mortgages with a 4% interest rate, but Lender A's has an APR of % while Lender B's APR is %. Mortgage Rates — as of August 14 ; Posted rate, APR ; 6-month convertible, %, % ; 6-month closed, %, % ; 6-month open, %, %. A good APR on a home loan depends on many factors. Partially, it based on the general interest rate at a given time. Mortgage rates ; Term, Posted, Special offer, APR ; 6 month fixed open, % · —, % ; 6 month fixed convertible, % · —, %. Enjoy great rates, flexible repayment options and a mortgage that makes it easy Annual Percentage Rate (APR) means the cost of borrowing for a loan. Rate % ; APR % ; Points ; Monthly Payment $1, The Annual Percentage Rate (APR) is based on a $, mortgage, 25 year Getting a mortgage pre-approval is a great way to find out how much you may be able. If your FICO score is between and , it's rated as 'Very Good'. Borrowers with scores in this tier receive notably lower mortgage interest rates because. What is the difference between mortgage rate vs. APR? How do I know what a good mortgage APR is? Learn how APR fits into the mortgage puzzle with U.S. Bank. History tells us that taking out loans at 5% to 10% APR might not be a big deal if you can handle the financial obligation. However, the best interest rate is.

Personal Loan In 10 Minutes

Borrow up to $ with a no fee, low rate personal loan. Apply for a personal loan in as few as 10 minutes and get funds in business days. Usually, you can apply for these types of personal loans online within minutes from the comfort of your own home. personal loans if you're approved before LoanNow offers quick installment loans. It's the fastest and easiest way to borrow, and you could even build your credit history as you repay. When the amount you need is small, it should be met instantly. This is why with Zype, you can apply for a personal loan up ₹5,00, in 5 minutes, without any. 5-Minute Application. All it takes is a few minutes. We're fast, easy and headache-free. Fast & Easy Approval. Get your quick loan approval online. Money in. Personal Loan - Apply for Instant Personal Loan Online. Get up to ₹5 lakhs 10 minutes of loan approval. Secure app. With ISO Most people complete the process in about 10 minutes. If you accepted your loan terms on a Monday through Friday, before p.m. CT, Spotloan will. Best Direct Deposit Loans With Approval in Minutes. Several online personal loan networks can approve your loan application in minutes. The money, however. A quick, easy and affordable way to get your personal loan approved in just 10 minutes. We offer affordable EMIs and quick approvals. Borrow up to $ with a no fee, low rate personal loan. Apply for a personal loan in as few as 10 minutes and get funds in business days. Usually, you can apply for these types of personal loans online within minutes from the comfort of your own home. personal loans if you're approved before LoanNow offers quick installment loans. It's the fastest and easiest way to borrow, and you could even build your credit history as you repay. When the amount you need is small, it should be met instantly. This is why with Zype, you can apply for a personal loan up ₹5,00, in 5 minutes, without any. 5-Minute Application. All it takes is a few minutes. We're fast, easy and headache-free. Fast & Easy Approval. Get your quick loan approval online. Money in. Personal Loan - Apply for Instant Personal Loan Online. Get up to ₹5 lakhs 10 minutes of loan approval. Secure app. With ISO Most people complete the process in about 10 minutes. If you accepted your loan terms on a Monday through Friday, before p.m. CT, Spotloan will. Best Direct Deposit Loans With Approval in Minutes. Several online personal loan networks can approve your loan application in minutes. The money, however. A quick, easy and affordable way to get your personal loan approved in just 10 minutes. We offer affordable EMIs and quick approvals.

Getting a personal loan is now just a matter of minutes with % Online Process, 10 Minute Disbursal and Direct Bank Transfer. Apply for a personal loan at. Cash in bank. Get the funds directly in your bank account within less than 10 minutes of loan approval 4 Lakh Personal Loan · 5 Lakh Personal Loan. Blogs. You're less than 10 minutes away from completing your online loan application with us. And you'll be guided through everything step by step. At least 10% of the applicants approved for these terms qualified for the lowest rate available based on data from 04/01/ to 06/30/ The rates shown are. Decisions take just minutes. Confidence can come quickly when you apply. Most decisions happen in under 15 minutes, and money may be available the same day. Navi is a simple app for personal loans. It needs minimum documentation. I applied for a loan it hardly took minutes for loan disbursal. Thank you Navi. There are many personal loan lenders to choose from, but a few in particular stand out for fast funding. To expedite your application, apply early during a. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Completing the online loan application: Takes just minutes to complete and see your offers* loan amount, ranging from 1% to 10%. (Percentage-based. Check your rate for an online personal loan in minutes without affecting your credit score. Get funded in as fast as 1 business day. Get quick emergency cash loans upto INR 1, within 30 minutes on just basic KYC. We provide short term loans online in India. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. We can help with financing. Other Loans – We offer a variety of personal loans to meet your needs. Let's get started! It only takes about 10 minutes. Can you get a $10K personal loan with bad credit? This depends on the terms Check rates in minutes with no credit score impact. With access to. Get prequalified in minutes without affecting your credit score. See personal loan 10 members. would refer friends to Oportun. 80, 5-star reviews. on. Apply in just minutes & get funded in minutes. Apply Online We offer multiple loan products, with amounts ranging from as low $10 to. When the amount you need is small, it should be met instantly. This is why with Zype, you can apply for a personal loan up ₹5,00, in 5 minutes, without any. Top 10 Digital Banks Enterprise Management Among the It takes about 3 minutes to get your personalized loan options and rates. The entire process, from loan approval to verification, is simple and does not take longer than 10 minutes. When your loan is approved, the funds will be. Loan amount: From ₹1, to ₹, Interest rates: From 0% to % per annum. Tenure: 62 days to 15 months. Kreditzy is a Personal Loan Platform for.

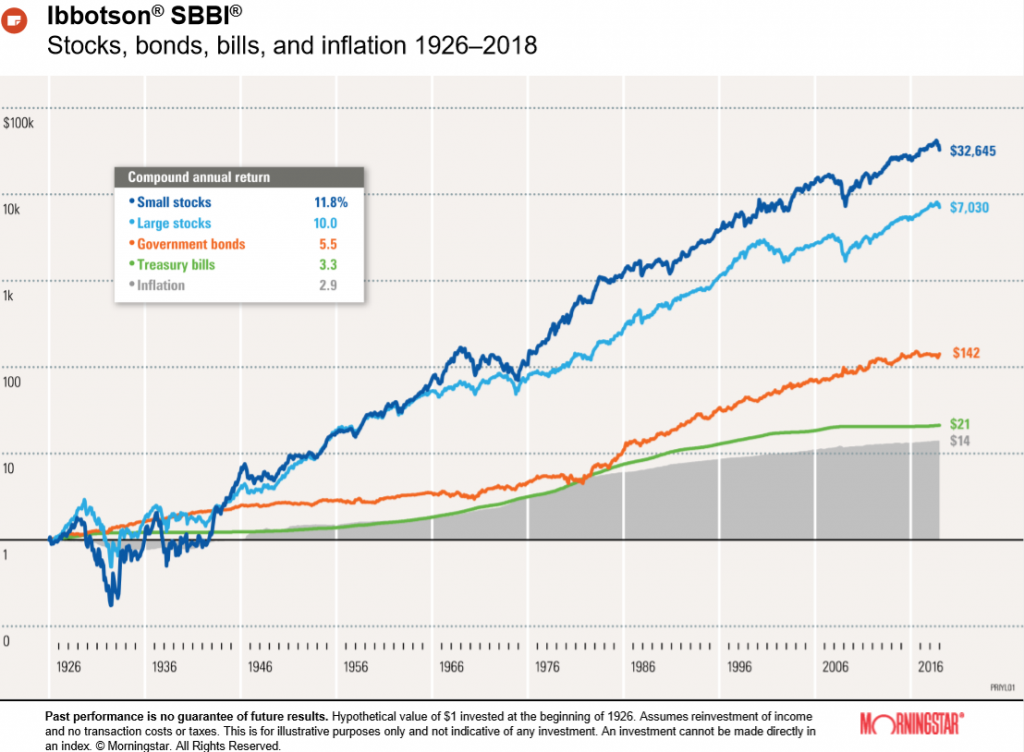

S&P 500 Long Term Investment

From my research, it seems like the S&P is the most consistent and least risky investment. I'm also thinking of putting money into a high interest savings. S&P Index Fund seeks total return by investing The holdings listed includes the Fund's long-term investments and excludes any temporary cash investments. How risky do you guys see putting all your money in the S&P ? It seems most people on this sub promote more diversified investing. Exhibit 1 shows calendar year returns for the S&P Index since The shaded band marks the historical average of 10%, plus or minus 2 percentage points. The numbers clearly show that the Nasdaq has significantly outperformed S&P index in terms of return over long term despite witnessing higher. One such legend is that the S&P Index always produces excellent long-term returns. By extension, investment pros and media suggest that you. The S&P has generally historically delivered returns through volatile markets. Read why investors should consider investing in this group of companies. S&P Index ; 52 Week Range 4, - 5, ; 5 Day. % ; 1 Month. % ; 3 Month. % ; YTD. %. Individuals can invest in the S&P through index funds or ETFs that follow the index. Investors can choose a taxable brokerage account, a (k), or an IRA. From my research, it seems like the S&P is the most consistent and least risky investment. I'm also thinking of putting money into a high interest savings. S&P Index Fund seeks total return by investing The holdings listed includes the Fund's long-term investments and excludes any temporary cash investments. How risky do you guys see putting all your money in the S&P ? It seems most people on this sub promote more diversified investing. Exhibit 1 shows calendar year returns for the S&P Index since The shaded band marks the historical average of 10%, plus or minus 2 percentage points. The numbers clearly show that the Nasdaq has significantly outperformed S&P index in terms of return over long term despite witnessing higher. One such legend is that the S&P Index always produces excellent long-term returns. By extension, investment pros and media suggest that you. The S&P has generally historically delivered returns through volatile markets. Read why investors should consider investing in this group of companies. S&P Index ; 52 Week Range 4, - 5, ; 5 Day. % ; 1 Month. % ; 3 Month. % ; YTD. %. Individuals can invest in the S&P through index funds or ETFs that follow the index. Investors can choose a taxable brokerage account, a (k), or an IRA.

History shows that the market typically moves in cycles. In the past 65 years, there have been six bull markets and six bear markets. Investment strategies. Five fundamental factors drive long-term stock returns: sales growth, changes in the share count (buybacks), margin growth, changes in the P/E multiple, and the. Since , the average annual total return for the S&P , an unmanaged index of large U.S. stocks, has been about 10%. Investments that offer the. We are also looking at returns over longer periods, which will include negative markets. November was the 13th consecutive “up” month, the best run for the. Is it worth investing dollars monthly in S&P (ETF) for a long-term investment? Absolutely its worth it. Let's have a look at what. To avoid common mistakes when investing in the S&P , investors should adopt a long-term perspective, avoiding market timing and emotional reactions to. SPDR S&P ETF Trust · $ billion · %, or $ annually on every $10, invested ; iShares Core S&P ETF · $ billion · % ; Invesco S&P Focus on the time you stay invested, not the timing of your investments. S&P Index is a market capitalization-weighted index based on the results of. The S&P is a capitalization-weighted index, meaning that it holds companies in proportion to their market values. For the past decade, some of the largest. A straightforward, low-cost fund with no investment minimum · The Fund can serve as part of the core of a diversified portfolio · Simple access to leading. past or future, of any investment. The S&P Index (S&P ) is an unmanaged index of stocks that is generally representative of the performance of. S&P 1 Year Return is at %, compared to % last month and % last year. This is higher than the long term average of %. The S&P 1. Without a doubt, the past decade was a sensational run for investors, with the S&P registering a total return of %, or % annually, through the s. This is a return on investment of 1,,%, or % per year. This lump-sum investment beats inflation during this period for an inflation-adjusted. Historically, it has made consistent returns over the long-term. According to Standard & Poor's, over since the S&P made an annual average return of. The S&P index is used as a benchmark and is difficult for active funds to beat. You can pick S&P index funds to match the market's long-term average. Low-Cost and Passive Strategy S&P investing strategy: S&P tracking funds typically have low management fees and follow a passive investment approach. The S&P is widely used to (i) direct capital through “passive” investing, (ii) benchmark investment portfolios, and (iii) evaluate firm performance. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80%. The most popular S&P ETF is SPDR S&P (SPY), which is a derivative that fully copies the dynamics of the S&P but costs much less.

Apr Vs Apy Crypto

APY (Annual Percentage Yield) reflects the interest earned on interest, while APR does not. As a result, APY is always higher than APR. Interest is generally. What is the difference between APR and APY? The difference between the two annual returns is that APY takes compounding interest into account while APR does not. APR, or Annual Percentage Rate, is essentially the yearly interest rate associated with borrowing or lending in crypto. The annual percentage yield (APY) is the interest rate earned on an investment in one year, including compounding interest. Both terms are used to measure the compensation from various types of crypto activities, such as staking, lending, and yield farming. You can get APR by staking and you have to pay if you apply for a crypto loan. The purpose of APR is so that the borrower can compare loan interest rates. Compound interest rates should be reflected as APY, while simple interest rates should be shown as APR. Each of these will determine how much interest a. The annual percentage yield, or APY, is the second widely used metric. This is used for investments you make or money you get, unlike the APR. It is often. Basically, APR is a good rough estimate and APY is an even better estimate with compounding. APY (Annual Percentage Yield) reflects the interest earned on interest, while APR does not. As a result, APY is always higher than APR. Interest is generally. What is the difference between APR and APY? The difference between the two annual returns is that APY takes compounding interest into account while APR does not. APR, or Annual Percentage Rate, is essentially the yearly interest rate associated with borrowing or lending in crypto. The annual percentage yield (APY) is the interest rate earned on an investment in one year, including compounding interest. Both terms are used to measure the compensation from various types of crypto activities, such as staking, lending, and yield farming. You can get APR by staking and you have to pay if you apply for a crypto loan. The purpose of APR is so that the borrower can compare loan interest rates. Compound interest rates should be reflected as APY, while simple interest rates should be shown as APR. Each of these will determine how much interest a. The annual percentage yield, or APY, is the second widely used metric. This is used for investments you make or money you get, unlike the APR. It is often. Basically, APR is a good rough estimate and APY is an even better estimate with compounding.

Banks in traditional finance and DeFi lending protocols need money or crypto from users to lend to borrowers. The amount given to the lenders over the year. APR stands for Annual Percentage Rate and it represents the yearly cost of borrowing money. It includes the interest rate that applies to your account. If you are interested in generating rewards with your crypto assets, you will sooner or later come across the abbreviations APR and APY. What is APY? Annual percentage yield, or APY, is the realized rate of return earned on an investment. · What's the Difference Between APY and APR? · Why Do Some. APR is a simpler metric; it shows a constant yearly rate. APR is often shown as the amount of interest on personal loans or credit card debt. APR represents the yearly rate charged for borrowing money. · APY refers to how much interest you'll earn on savings and it takes compounding into account. · The. In a nutshell APY uses a compound interest calculation whereas APR does not. APY would therefore show a bigger number for the resultant. APR And APY In Crypto: A Complete Guide” by Olayiwola Dolapo highlights the differences between Annual Percentage Rate (APR) and Annual. APY vs. APR: What It Means For Crypto. APR is often used to show the interest paid on borrowings in Crypto such as in loans from DeFi applications. However. Therefore, if you're comparing the same percentage number, with one as APR and one as APY, e.g. % APR vs % APY, it's safe to assume that the APR option. APR: This is the annual rate of return that doesn't consider compounding. It's straightforward, providing a nominal rate of return over a year. The annual percentage yield (APY) is the interest rate earned on an investment in one year, including compounding interest. The most significant difference between APR and APY lies in the impact of compounding. While APY refers to the expected annual profit earned. (Annual Percentage Rate vs. Annual Percentage Yield) Both methods compute the interest paid on an investment. However, APR applies a flat annual rate or. They work the same as they do in fiat finances: APR is the interest a trader will pay on a crypto loan over the course of a year, while APY is important for. Two commonly used terms in the crypto world are APR (Annual Percentage Rate) and APY (Annual Percentage Yield). While they may sound similar, they represent. APR vs APY In Crypto: Which Is Better? Naturally, APR rates are better for borrowing money, while APY is more beneficial for investing. The effect of. Many crypto projects allow users options to earn interest on their investments through staking, validating, or delegating their cryptocurrency to better secure. APR (annual percentage rate) and APY (annual percentage yield) are important concepts in calculating interest on a variety of crypto investments or loans. What is APY? Annual percentage yield, or APY, is the realized rate of return earned on an investment. · What's the Difference Between APY and APR? · Why Do Some.

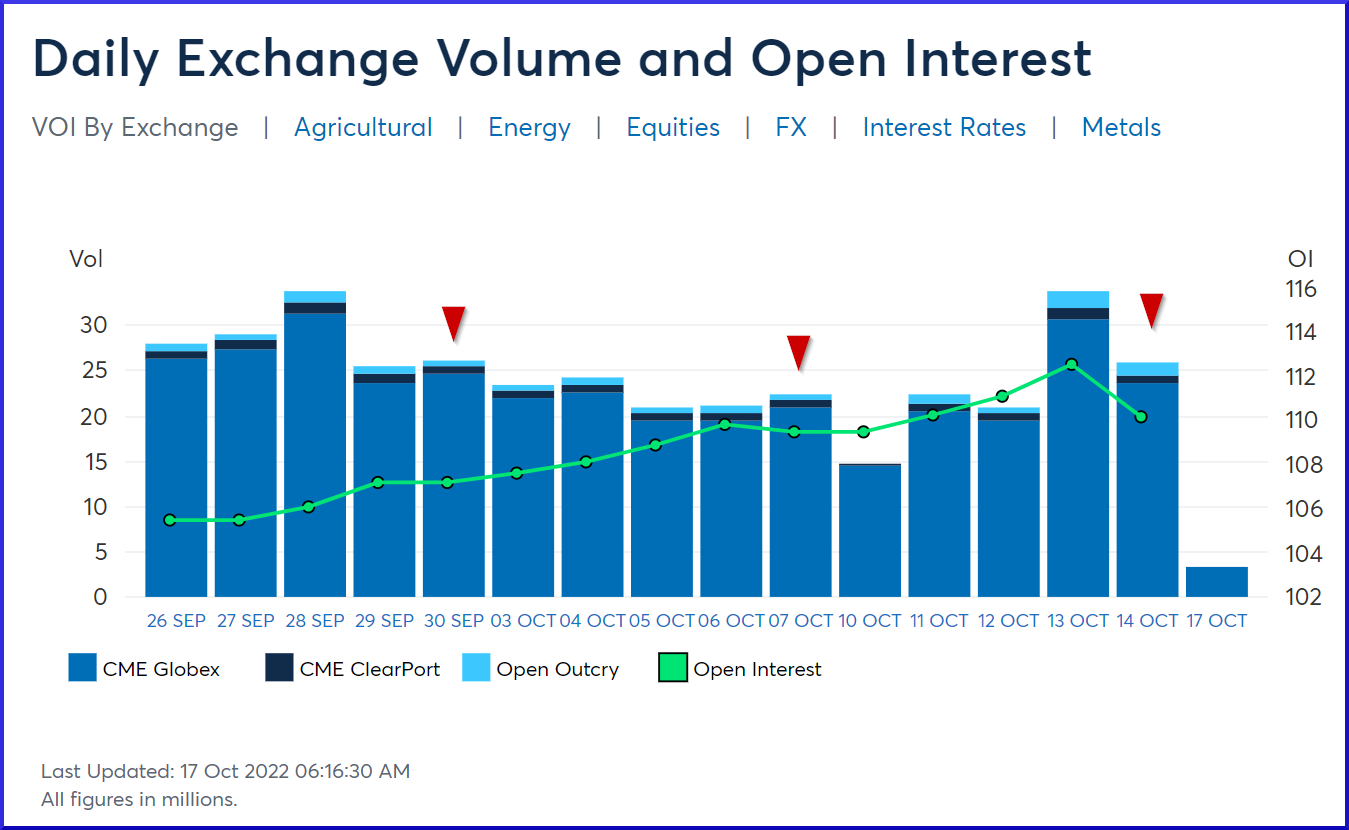

Unusual Open Interest

The open interest at market close was around 1, so I assume this was a buy to open order as today it has now updated to around 45K. The amount of contracts that existed in the market heading into the current trading day is the Open Interest. Both of these are displayed below the premium. High open interest indicates that money is entering the market, new long positions are being taken, and the market is decidedly bullish. Unusual options activity identifies a single option trade with a volume-to-open-interest ratio (V/OI) equal to or above 10, which means the volume of the trade. We often discuss the importance of the relationship between Volume and Open Interest. The way we confirm opening trades on a day with high. Unusual options activity is identified as a single option trade with a volume-to-open-interest ratio (V/OI) equal to or above 10, meaning that the volume of the. View the open interest changes for each option contract in the premarket before the trading session. See which contracts open interest changed over night. Highest Open Interest Stock Options ; NVDA, NVIDIA Corporation, 26,, ; TSLA, Tesla, Inc. 6,, ; AAPL, Apple Inc. 6,, ; INTC. High and rising open interest suggests the option has active trading and participant interest while declining open interest means traders are closing out. The open interest at market close was around 1, so I assume this was a buy to open order as today it has now updated to around 45K. The amount of contracts that existed in the market heading into the current trading day is the Open Interest. Both of these are displayed below the premium. High open interest indicates that money is entering the market, new long positions are being taken, and the market is decidedly bullish. Unusual options activity identifies a single option trade with a volume-to-open-interest ratio (V/OI) equal to or above 10, which means the volume of the trade. We often discuss the importance of the relationship between Volume and Open Interest. The way we confirm opening trades on a day with high. Unusual options activity is identified as a single option trade with a volume-to-open-interest ratio (V/OI) equal to or above 10, meaning that the volume of the. View the open interest changes for each option contract in the premarket before the trading session. See which contracts open interest changed over night. Highest Open Interest Stock Options ; NVDA, NVIDIA Corporation, 26,, ; TSLA, Tesla, Inc. 6,, ; AAPL, Apple Inc. 6,, ; INTC. High and rising open interest suggests the option has active trading and participant interest while declining open interest means traders are closing out.

Open Interest represents the number of outstanding contracts for an option. If the first trader to trade an option contract purchases 10 contracts. Unusual options activity shows a large amount of open interest (aka OI) with particular strikes and might predict a large underlying move. Stay tuned for the next article where we will show you how to analyze the option chain, time and sales data and open interest. Contributed by Dmitry. Open interest is the total number of outstanding options contracts that have not yet been exercised or expired. An increase in open interest can be an indicator. Unusual Options Activity identifies options contracts that are trading at a higher volume relative to the contract's open interest. Looking now at Unusual Options Activity, the higher volume is compared to open interest, the better. This indicates above average interest in the commodity. . Open Interest is the total number of open option contracts that have been traded but not yet liquidated by either an offsetting trade or an exercise or. Volume/Open Interest · High relative volume in OTM or short-dated options · Large inter-market sweep orders in one contract. Unusual Options Activity identifies options contracts that are trading at a higher volume relative to the contract's open interest. Unusual Options can. Unusual Options Activity detects options contracts trading at a significant volume relative to the contract's open interest. Unusual Option Activity and Open Interest. Yesterday, I noticed $BMBL had 45K volume on the $9 strike puts expiring in June. The open interest. In short, unusual options activity can show you where the “smart money” is. Because there's unusually high interest in an asset, it's more likely that. The Open Interest is the total number of options or futures contracts that are not closed on a particular day. In futures markets, open interest represents the number of contracts traded (opened) but not yet liquidated by either an offsetting trade or delivery.2 For each. Yahoo Finance's list of highest open interest options, includes stock option price changes, volume, and day charts for option contracts with the highest. Open Interest. OI Analysis. Catalyst Events. Biotech Stock Catalysts. Tools Unusual Options Activity? Displays a list of equities whose options are. shows unusual option activity, which are contracts that are trading at a higher volume relative to the open interest of the contract. Unusual options activity refers to a significant increase in trading volume in a particular stock's options contracts that is not typical for that stock. Open interest measures the total number of options contracts that exist for a particular stock. Open interest increases as more options are traded to open a.

How To Get A Better Interest Rate On Student Loans

In this payment model, a lower interest rate could make loan payments more manageable for some borrowers and thereby reduce defaults. The effect is quite small. A fixed-rate loan does not change over the life of the loan. The interest rate on a variable-rate loan may increase or decrease depending on changes to the. Take extra income you might have and make additional payments toward your student loans. This will pay off your loans quicker, which lowers the total interest. To lower your interest rate on federal student loans, you basically need to refinance them with a private lender. In the federal student loan program, you are. For undergraduate, graduate, and refinance loans, most students may benefit from obtaining a creditworthy co-signer. Having a co-signer may increase your. A fixed interest rate is set at the time of application and does not change during the life of the loan unless you are no longer eligible for one or more. Get on the SAVE repayment plan for your Federal student loans. Consider taking advantage of the on ramp period for Federal loans to prioritize. One of the most important factors to consider when shopping for a student loan is the loan's interest rate. Beyond simply how much your child can borrow, the. If you're looking to lower your student loan interest rate, you have a few options: Improve your credit score before applying: If you're applying for a loan. In this payment model, a lower interest rate could make loan payments more manageable for some borrowers and thereby reduce defaults. The effect is quite small. A fixed-rate loan does not change over the life of the loan. The interest rate on a variable-rate loan may increase or decrease depending on changes to the. Take extra income you might have and make additional payments toward your student loans. This will pay off your loans quicker, which lowers the total interest. To lower your interest rate on federal student loans, you basically need to refinance them with a private lender. In the federal student loan program, you are. For undergraduate, graduate, and refinance loans, most students may benefit from obtaining a creditworthy co-signer. Having a co-signer may increase your. A fixed interest rate is set at the time of application and does not change during the life of the loan unless you are no longer eligible for one or more. Get on the SAVE repayment plan for your Federal student loans. Consider taking advantage of the on ramp period for Federal loans to prioritize. One of the most important factors to consider when shopping for a student loan is the loan's interest rate. Beyond simply how much your child can borrow, the. If you're looking to lower your student loan interest rate, you have a few options: Improve your credit score before applying: If you're applying for a loan.

With this undergraduate student loan repayment option, you'll likely pay more for your total student loan cost, since unpaid interest will be added to your. Considering the average fixed interest rate among lenders we sampled was around %, a rate on the low end of this range could be considered good. The. Because approval for a private student loan is based on creditworthiness, a cosigner may help a student get loan approval and a lower rate. Required Markups to. Because approval for a private student loan is based on creditworthiness, a cosigner may help a student get loan approval and a lower rate. Required Markups to. Pay More than Your Minimum Payment. Paying a little extra each month can reduce the interest you pay and reduce your total cost of your loan over time. Continue. 1. I got my credit in tip-top shape · 2. I researched lenders · 3. I compared interest rates · 4. I submitted an application and made sure to get the best deal · 5. You can choose which student loans to pay off first by making more than the minimum amount due on whatever loan you're targeting. However, many borrowers have a. These are fixed payment repayment plans, which base your monthly payment amount on how much you owe, your interest rate, and a fixed repayment time period. To. That means if your credit is in good standing, you could qualify for a rate that's better than your original loans, regardless of whether you currently have a. When we're in an environment of rising interest rates, any kind of loan—car, house, and education—can be more expensive to get and pay off. While you can't. Make a list of your student loans. Include whether they're private or federal, monthly payment and due date, the current and principal balances, the interest. To calculate your student loan interest, calculate the daily interest rate, then identify your daily interest charge, and then convert it into a monthly. Best low-interest student loans ; Best overall. SoFi · % to % · % to % ; Best for variety of repayment options. College Ave · Go to lender site. In this payment model, a lower interest rate could make loan payments more manageable for some borrowers and thereby reduce defaults. The effect is quite small. One of the most important factors to consider when shopping for a student loan is the loan's interest rate. Beyond simply how much your child can borrow, the. With this undergraduate student loan repayment option, you'll likely pay more for your total student loan cost, since unpaid interest will be added to your. So the lower your principal, the less interest you'll have to pay each month. Plus, when your principal balance reaches $0, you have successfully paid your loan. To calculate your student loan interest, calculate the daily interest rate, then identify your daily interest charge, and then convert it into a monthly. If you are financially secure with stable employment · If you currently have a high interest rate (especially for private student loans) · If you can lower the. It might be tempting to initially select a variable interest rate or have a longer repayment plan (that carries a lower monthly payment), but a shorter.